VIDEO: Bill O’Reilly Leaving Newt Gingrich Fundraiser; Hits Citizen Journalist with Umbrella

Here’s an interesting video showing Fox News personality, Bill O’Reilly, leaving a fundraiser for Presidential candidate, Newt Gingrich. When approached by a citizen journalist, Branden Lane, O’Reilly hits the cameraman with his umbrella and then asks a nearby policeman for help.

College Board Report Shows Tuition Costs Continue to Soar

It is no secret that the cost of a college education continues to soar. But, by planning ahead you can determine which of several creative methods will work best for you. Some people will choose the 529 College Savings Plans that are available while others will choose using a cash value life insurance policy to help pay for these cost.

Ron Paul Declares His Support for Israel

Congressman and Republican presidential candidate Ron Paul defended his support for Israel in an interview yesterday with Newsmax. We recently reported that The Republican Jewish Coalition did not invite Paul to the presidential-candidates forum the organization hosted yesterday.

Ron Paul Thwarts Attack By Mainstream Media

Here's an interesting exchange between Bob Schieffer from CBS News and Rep. Ron Paul. Despite Schieffer's best attempts to distort Paul's views, Paul courageously defends himself. The media bias against Ron Paul is obvious.

Rep. Ron Paul Not Invited to Forum hosted by Republican Jewish Coalition

Although Rep. Ron Paul (R-Texas) is the GOP candidate currently polling around third in New Hampshire and second in Iowa, he has not been invited to a presidential-candidates forum hosted by the Republican Jewish Coalition on Wednesday, December 7th.

FTMWeekly Radio Show: Gerald Celente Speaks Out on the MF Global Scandal

Podcast: Play in new window | Download (Duration: 1:16:58 — 70.5MB) | Embed

Jerry is joined by Gerald Celente for a discussion on his recent financial losses in gold futures with the bankrupt MF Global. Additionally, Gerald and I will discuss current events as well as what to expect in the days ahead.

WikiLeaks Exposes Details of Global Spy Industry

WikiLeaks founder Julian Assange just published hundreds of files detailing a global industry that gives governments tools to spy on their citizens.

Secret Federal Reserve Loans to Wall Street Banks Nets $13 Billion in Profits

Wall Street Banks Earned Billions In Profits Off $7.7 Trillion In Secret Fed Loans Made During The Financial Crisis

Precious Metals Market Update – November 19, 2011

Podcast: Play in new window | Download (Duration: 13:06 — 12.0MB) | Embed

Where are gold and silver prices heading next? In this week’s Precious Metals Market Update segment, precious metals advisor Tom Cloud will be here to help us sort out the madness in the financial markets.

Gerald Celente’s Gold Account Looted By MF Global Banksters

Popular trends forecaster, and regular guest on the Follow the Money Weekly radio show, Gerald Celente has reportedly had his gold futures trading account seized amid the bankruptcy proceedings involving the colossal banking failure, MF Global. In the video clip below, Celente explains his experience.

What Jerry Thinks: Supreme Court Takes On Obamacare, Strange Lines in Gobi Desert

Jerry gives some brief comments on the Supreme Court’s recent decision to hear a challenge to Obamacare. He also discusses what to expect on this weekend’s FTMWeekly radio show which includes special guests, Peter Schiff, and David Morgan. And what are those strange lines in the Chinese desert?

Precious Metals Market Update – November 12 2011

Podcast: Play in new window | Download (Duration: 6:42 — 6.2MB) | Embed

Where are gold and silver prices heading next? In this week’s Precious Metals Market Update segment, precious metals advisor Tom Cloud will be here to help us sort out the madness in the financial markets.

Peter Schiff Takes the Crazed Occupy Wall Streeters to School

Economist and author Peter Schiff recently braved a stroll through the loony mob (affectionately referred to as the “Occupy Wall Street” movement by the mainstream media) currently inhabiting Lower Manhattan. He was armed with a video camera and a microphone. There is no need for further comment. Just watch the video for yourself.

There is no need for further comment. Just watch the video for yourself.

FTMWeekly Radio Show – Do You Have the Midas Touch? An Interview with Robert Kiyosaki

Podcast: Play in new window | Download (Duration: 55:55 — 76.8MB) | Embed

This week’s radio show includes: an interview with best-selling author and successful investor, Robert Kiyosaki about his latest book, Midas Touch.

Precious Metals Market Update – October 15 2011

Podcast: Play in new window | Download (Duration: 5:58 — 3.7MB) | Embed

Where are gold and silver prices heading next? In this week’s Precious Metals Market Update segment, precious metals advisor Tom Cloud will be here to help us sort out the madness in the financial markets.

Retirement Minute: Four Questions That Current Medicare Enrollees Should Be Asking Now

Podcast: Play in new window | Download (Duration: 2:26 — 1.7MB) | Embed

The Medicare open enrollment period is now here and this is the time during which people with Medicare can make new choices and pick plans that work best for them. Here’s four questions to be asking now.

FTM Weekend Roundup – October 8, 2011

After beginning the fourth quarter near bear market territory, the major U.S. stock indexes staged a rally this week on news that Europe would step in to help its ailing banking sector along with some better than expected economic data in the U.S.

Precious Metals Market Update – October 8, 2011

Podcast: Play in new window | Download (Duration: 7:24 — 5.3MB) | Embed

Where are gold and silver prices heading next? In this week’s Precious Metals Market Update segment, precious metals advisor Tom Cloud will be here to help us sort out the madness in the financial markets.

Retirement Minute: Three Tax Planning Tips for 2012

Podcast: Play in new window | Download (Duration: 2:01 — 1.6MB) | Embed

Here’s three tips to reduce your taxes in 2012. Now that October has arrived, I would like to challenge you to take this month and start planning for how you are going to reduce your taxes in year 2012. Your CPA can be a good source to help you with this planning by suggesting different tax benefits that you can implement.

Bank of England: This is the Worst Financial Crisis… Ever

The Governor of the Bank of England says that we are in the worst financial crisis ever. We hate to say it but we actually agree with a central banker right now.

25 Financial Documents That Will Protect You and Your Family

With the recent passing of Apple’s Steve Jobs at the young age of 56, we are all reminded that life is fragile and can end much earlier than perhaps we planned. One of the most selfless things that we can do is to confront our mortality now, while we are healthy, and make the hard decisions about how you want our estate handled when we pass.

Putin Calls for New “Eurasian Union”

Here are the latest details on the coming Eurasian Union. Vladimir Putin, the Prime Minister of Russia, is intent on building a “Eurasian Union” of ex-Soviet states, according to an article in the Izvestia newspaper on Tuesday. Here’s the details…

Bernanke Admits the Bogus “Economic Recovery” is Faltering

Who didn’t see this coming? The bogus “economic recovery” that the current administration, the U.S. Treasury, and the Federal Reserve have been touting for the last 18 months is now, according to Fed Chief, Ben Bernanke, “close to faltering.”

S&P Sinks to 2011 Low, Nearing Bear Market

The Standard and Poor’s 500 index fell to its 2011 low from the latest news in Greece’s financial crisis; namely, Greece said it will not hit the deficit reduction targets in part of the agreement of its bailout deal.

Precious Metals Market Update – October 1, 2011

Podcast: Play in new window | Download (Duration: 17:33 — 11.1MB) | Embed

Where are gold and silver prices heading next? In this week’s Precious Metals Market Update segment, precious metals advisor Tom Cloud will be here to help us sort out the madness in the financial markets.

Retirement Minute: Should You “Undo” Your Recent Roth IRA Conversion?

Podcast: Play in new window | Download (Duration: 2:31 — 1.7MB) | Embed

If your Roth IRA has sustained losses as a result of the recent market downturn, you may want to consider whether it makes sense to undo your conversion. Here’s what you need to know.

FTM Quarterly: A Financial Newsletter by Jerry Robinson

The FTMQuarterly Newsletter is the premier financial publication written by economist Jerry Robinson and his staff. Subscribe now!

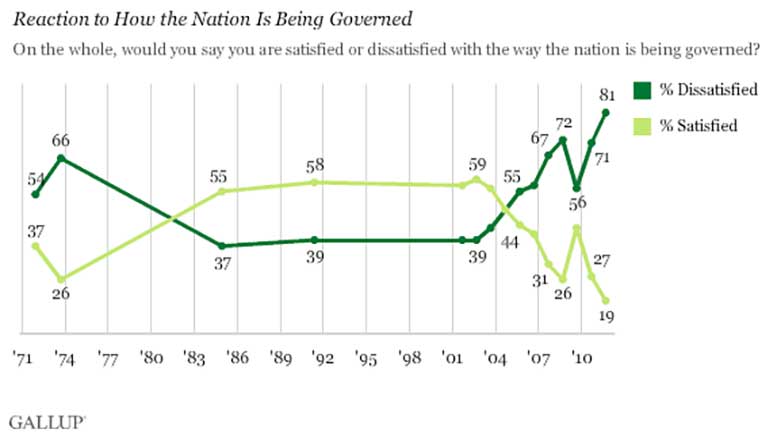

GALLUP POLL: Government “is” the Problem

A record-high 81% of Americans are dissatisfied with the way the country is being governed, adding to negativity that has been building over the past 10 years.

NJ Church Gives Away $30,000 in “Reverse Collection” Baskets

This was one collection basket parishioners couldn’t pass up. Liquid Church of New Jersey allowed parishioners at its Sunday services to forgo donating and instead take money out of the collection basket.

‘Massive jobs shortfall’ predicted for global economy

International Labour Organisation said the group of developing and developed nations had seen 20m jobs disappear since the financial crisis in 2008.

10 Cities Where Rents Are Rising the Most

Here are 10 cities where rents are rising the most, according to data provided by research firm REIS.

Meet the Richest People in America…

Despite the stalled economy, the nation’s wealthiest are worth a combined $1.53 trillion, nearly equivalent to the GDP of our neighbor Canada. Their total wealth is up 12% in the year through August 26, when we took a snapshot of everyone’s net worth, meaning these affluent folks did slightly better than the markets; the S&P 500, for instance, was up 10% in that time.

10 Things Social Security Won’t Tell You

Worried about the future of Social Security? You’re far from alone. The Social Security Administration itself has said that unless something is done to reform the system, it will burn through its funds within the next few decades.

S&P Downgrades Italy

Standard and Poor’s downgraded its unsolicited ratings on Italy by one notch to A/A-1 and kept its outlook on negative, a major surprise that threatens to add to concerns of contagion in the debt-stressed euro zone.

IMF Sharply Downgrades Outlook for U.S, Europe

The world economy has entered a “dangerous new phase,” according to the chief economist of the International Monetary Fund. As a result, the international lending organization has sharply downgraded its economic outlook for the United States and Europe through the end of next year.

Hedge Fund Heavyweight Says Gold Heading to $2,200

Gold, platinum and Brent oil will lead gains in commodities as investors seek to protect their assets and shortages emerge, according to Tony Hall, the hedge-fund manager who earned 33 percent for his clients this year.

Retiree Benefits for the Military Could Face Cuts

As Washington looks to squeeze savings from once-sacrosanct entitlements like Social Security and Medicare, another big social welfare system is growing as rapidly, but with far less scrutiny: the health and pension benefits of military retirees.

Precious Metals Market Update – September 17, 2011

Podcast: Play in new window | Download (Duration: 5:07 — 2.1MB) | Embed

In this week’s Precious Metals Market Update segment, precious metals advisor Tom Cloud will be here to help us sort out the madness in the financial markets.

FTMWeekly Financial Radio Show – On the Road to a One World Currency

Podcast: Play in new window | Download (Duration: 58:47 — ) | Embed

On this week’s program, we will discuss what is happening in the global economy and how bad things are really going to get. Our special guest today says things are just getting warmed up and that the real economic pain still lies straight ahead. Trace Mayer will be here to discuss the economy, offshore investing, as well as his book, The Great Credit Contraction.

Gloom and Doom: Consumer Sentiment Plunges to 31-Year Low

Consumer sentiment inched up in early September but Americans remained gloomy about the future with their expectations falling to the lowest level since 1980, a survey released on Friday showed.

Gen Y’s $2 Million Retirement Price Tag

Retirement won’t be impossible for Generations X and Y, but they will need to save considerably more than the baby boomers to make up for less employer and government help.

10 Shortcuts to Find a Retirement Haven Abroad

There’s no such thing as the world’s best place to retire. There are many appealing options for a new life in retirement overseas.

A Roth 401(k) may be in your future

When it comes to choosing the best place to stash your retirement savings, the answer, at least in part, depends on your likely tax situation once you stop working.

5 Questions Every Worker Should Ask Before Retirement

Wall Street’s recent turmoil has many investors questioning whether they will have enough to retire the way they’ve always dreamed, or to retire at all, for that matter.

Go East, My Son! Job Seekers Flock to Asia

The weak job market in the U.S. is sending many in search of a meaningful career headed to Asia, experts say.

SAT Scores Fall Nationwide: Another Sign of U.S. Economic Decline

The College Board today announced that 43 percent of 2011 college-bound seniors met the SAT® College and Career Readiness Benchmark.

Trump’s New Gold Standard

A tenant recently paid Donald Trump in solid gold bullion instead of in cash. Is this a new trend?

Income for Life, Guaranteed! (Sort of)

Low interest rates and a weak economy make it hard for retirees to turn their nest eggs into paychecks. Some strategies for coping and cashing in.

Gold alert: An alarming update from Europe

A new trend in Austrian (and perhaps the rest of Europe’s) banking policies suggests that certain interested parties are attempting to control the sale and personal acquisition of gold/silver as safe haven assets. What we experienced first hand should be a wake up call for not just Europeans, but Americans as well.

Read the article…

Income Slides to 1996 Levels

The income of the typical American family—long the envy of much of the world—has dropped for the third year in a row and is now roughly where it was in 1996 when adjusted for inflation.