SHOW NOTES – 2/1/14

Financial Freedom Bootcamp 2014 : Part 4

Plus, a stock idea for profiting from GMO-free foods

_________________________________

Build and Diversify Your Investments

Last week I covered Level Three of our Five Levels of Financial Freedom. Level Three is all about building and diversifying your financial reserves. In Level One, you put together an emergency reserve of savings, food, water, and a Go Bag. Now, in Level Three, you will build upon this emergency reserve to create a solid financial reserve of liquid savings and food and water. Savers make better investors, so it is vital that you do not skip Level Three in order to more quickly get to the “fun part” of investing.

Listen to Financial Freedom Bootcamp 2014 : Part 3 >>

Today, I will cover Level Four. Level Four is all about building and diversifying your investments. Recall from Level One that you began a systematic savings plan, ideally saving at least 15% of your gross income. By now you have six months of your monthly income saved and diversified in liquid assets that will help protect your savings from inflation (from Level Three). Now that you have your savings reserve, you do not stop saving 15% of your income. But rather than keeping it in liquid savings, you will now divert this 15% into investments. If you ever drop below your six months of liquid savings, you will immediately stop adding new money to your investments, replenish the six months of savings, and then resume adding to your investment pool.

Today, I will cover Level Four. Level Four is all about building and diversifying your investments. Recall from Level One that you began a systematic savings plan, ideally saving at least 15% of your gross income. By now you have six months of your monthly income saved and diversified in liquid assets that will help protect your savings from inflation (from Level Three). Now that you have your savings reserve, you do not stop saving 15% of your income. But rather than keeping it in liquid savings, you will now divert this 15% into investments. If you ever drop below your six months of liquid savings, you will immediately stop adding new money to your investments, replenish the six months of savings, and then resume adding to your investment pool.

Here is a brief overview of Level Four and its components:

- Invest Broadly Across Various Asset Classes

- Remember P.A.C.E. for Inflation Protection (P = Precious Metals, A = Agriculture, C = Commodities, E = Energy)

- Avoid Overweighting in One Area

- Trade Cash for Cashflow When Possible

- Create Multiple Streams of Income

Invest Broadly Across Various Asset Classes

Although you may have a diversified portfolio of stocks, this first step of Level Four advocates that you diversify across many different asset classes, not simply stocks. So, what is an asset class? There are varying definitions in the investment world, but we define an asset class as a group of investments that have similar characteristics and behave similarly in the marketplace. Some of the common asset classes include:

- U.S. Stocks

- Non-U.S. Stocks

- Treasury Bonds

- Precious Metals

- U.S. Housing Prices

- Inflation

- Commodities

- Corporate Bonds

- And many others…

The goal in Level Four is to stay diversified across many different asset classes. You cannot consider yourself diversified if you own Microsoft stock, Apple stock, Chevron stock, and a few bonds. These are all paper assets. You want to have hard assets as well, like physical precious metals, real estate, or others. Even owning your own business is a great way to get diversified.

Remember P.A.C.E. for Inflation Protection

As I have mentioned over and over on this podcast, the size and scope of the economic problems facing America are breathtaking. And, in my opinion, these problems will result in widespread inflation. Several years ago, in an effort to develop my own investment strategy to weather the coming inflation, I designed something now known as the P.A.C.E. investment philosophy. P.A.C.E. is a simple acronym that stands for: P= Precious Metals, A= Agriculture, C=Commodities, E= Energy. Historical data demonstrates that these four asset classes, also known as hard assets, have performed extremely well during times of inflation. These hard assets are tangible investments that you can physically touch and handle. We have been focused on these areas for several years, and the overall returns have been stellar. Of course, no investment goes up in a straight line. Our strategy has been to add aggressively to our positions during periods when the assets have declined in price.

Since 2006, I have been urging those who are concerned about America’s economic woes to consider diversifying their investments into these areas. In 2012, we launched our own actively managed P.A.C.E. Portfolio (managed by Jay Peroni, CFP). This portfolio is composed of twenty stocks hand-picked by myself and Jay. FTM Insiders enjoy 24/7 access to the portfolio and real-time email alerts when we add or sell a stock. Our Insiders also receive Jerry Robinson’s exclusive list of ETF investing ideas for each of the four areas of P.A.C.E., along with buy, hold, and sell signals.

Since 2006, I have been urging those who are concerned about America’s economic woes to consider diversifying their investments into these areas. In 2012, we launched our own actively managed P.A.C.E. Portfolio (managed by Jay Peroni, CFP). This portfolio is composed of twenty stocks hand-picked by myself and Jay. FTM Insiders enjoy 24/7 access to the portfolio and real-time email alerts when we add or sell a stock. Our Insiders also receive Jerry Robinson’s exclusive list of ETF investing ideas for each of the four areas of P.A.C.E., along with buy, hold, and sell signals.

BECOME AN FTM INSIDER!

Avoid Overweighting in One Area

You have undoubtedly heard the phrase, “Don’t put all your eggs in one basket.” This wisdom is certainly true for your investments, especially under current government spending and regulatory conditions. For the real estate investor who has 100% of his investable money in real estate, what happens if your local government decides to raise property taxes by 10%, 20%, or more? For the family who has much of their money tied up in a 401(k) at work, what happens in the federal government chooses to impose an extra 50% tax on all distributions?

This is why we avoid overweighting in any one area… because the “rules of the game” can change at any moment. What are the rules of the game when it comes to your finances? The rules are found in the IRS tax code (coupled with state and local tax codes), and the Federal government makes those rules. Remember, the rules affect almost every financial incentive that you have, from the incentive to save money and give money, to your incentive to switch jobs, even your incentive to have children. Currently, the tax code favors a few key things:

Investments With Favorable Tax Treatment

- Owning a Business

- Properly Structured Cash-Value Life Insurance

- Real Estate

- Trusts

Trade Cash for Cashflow When Possible

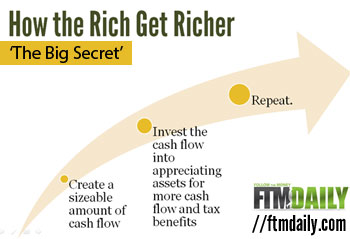

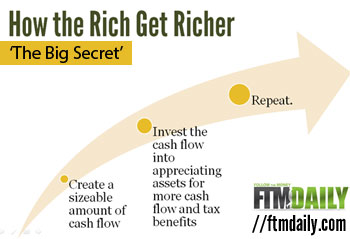

If I were to ask you, “Would you rather have $10,000 right now, or $200 per month for the next five years?” what would you choose? Hopefully, you would choose the $200 per month (unless you are 90 years old!). The truly wealthy individuals in this world do not think in terms of net worth or how much money is sitting in their bank accounts, they are much more concerned about creating cashflow. There is a three-step process to creating wealth (see chart below) that you should keep in mind in Level Four. If you can master this process, you can create true, lasting wealth in any economy.

22 Income Streams You Can Create Now and in Retirement >>

Create Multiple Streams of Income

The average American family has three income streams: 1. Husband’s job; 2. Wife’s job; 3. Interest-bearing CD or savings account. This is a scary way to live, especially in the age of outsourcing and computerizing tasks.

The average American family has three income streams: 1. Husband’s job; 2. Wife’s job; 3. Interest-bearing CD or savings account. This is a scary way to live, especially in the age of outsourcing and computerizing tasks.

Even more frightening is that the average American retiree has only two income streams: 1. Social Security benefits, 2. Pension/401k/IRA distributions. Imagine if one of your income streams dried up. What would you do? Would you have to rush out and get the first (lousy) job you can find, or would you have the opportunity to wait until the perfect job becomes available? Would you be relying upon unemployment income from the government to sustain your family’s living expenses? What if you become disabled or partially disabled?

If you are like most Americans, the answers to these questions is not pretty. But we have a solution: CREATE MULTIPLE STREAMS OF INCOME. By creating multiple streams of income, you do not lie awake at night worrying whether or not you will get laid off or whether or not Social Security will continue sending your checks every month. This concept is taught in the Bible when the book of Genesis says:

“Now Abram was very rich in livestock, in silver, and in gold.” (Genesis 13:2)”

Abraham also had herdsmen and servants, which meant he was an employer… he was a business owner. We would do well to pattern our lives after this example in order to truly obtain financial freedom.

Receive our 100% FREE FTMDaily Daily News Briefing Free Right in Your Inbox

Hard-hitting news and insights that the mainstream media won’t touch >>

No spam guarantee!

Update for Precious Metals Investors

Tom Cloud – Precious Metals Advisor

Tom Cloud joins us for the latest in the gold and silver markets and shares some of the fundamental and technical factors that are affecting prices right now.

Tom Cloud joins us for the latest in the gold and silver markets and shares some of the fundamental and technical factors that are affecting prices right now.

Tom Cloud:Probably the most startling figure of all that we’ve seen is that one year ago, in January of 2013, there were 20 claims for each ounce of gold in the bonded warehouses. Today, one year later, it’s over 100, like maybe 102 claims. You can understand easily why gold took a 28% dive last year when you’ve got a hundred people that think they own gold when only one of them truly does, and that person has that gold in their possession. This is only going to get worse as we go forward.

Read/Print the Audio Transcript

Precious Metals Investing 101 – Free Educational Resources

Click here for access to over 10 hours of free precious metals investing educational resources >>

Trigger Trade Report

Next, Jennifer Robinson is here to update our FTM Insiders on Trigger Trading activity for the past week. We were stopped out of one stock, ticker symbol VXX, for a 3.99% loss. We still have four stocks in play (including NHF up 1.87% and SH up 0.11%), and are awaiting the trigger price on seven stocks.

Recent Trigger Trade Performance

| Ticker | Buy Date | Buy Price | Sell Date | Sell Price | Days Held | Profit/Loss % |

| VXX | 1/27/14 | $45.58 | 1/28/14 | $43.76 | 2 |  -3.99% -3.99% |

| CW | 1/22/14 | $66.05 | 1/24/14 | $63.41 | 3 |  -3.99% -3.99% |

| HAR | 1/13/14 | $86.03 | 1/22/14 | $90.33 | 7 |  4.99% 4.99% |

| GDX | 1/13/14 | $22.58 | 1/22/14 | $23.39 | 7 |  3.58% 3.58% |

| CI | 1/14/14 | $88.67 | 1/22/14 | $90.12 | 6 |  1.63% 1.63% |

| DAL | 1/8/14 | $29.53 | 1/17/14 | $31.23 | 8 |  5.75% 5.75% |

| PKG | 12/18/13 | $62.65 | 1/17/14 | $65.07 | 21 |  3.86% 3.86% |

| MAN | 12/16/13 | $83.02 | 1/13/14 | $85.55 | 19 |  3.04% 3.04% |

| SKM | 12/2/13 | $24.12 | 1/13/14 | $23.99 | 29 |  -0.54% -0.54% |

View More Stock Trading Performance Results >>

Recent Podcasts by Jerry Robinson

DISCLAIMER: The above trading ideas are from my own personal stock watchlist and are for educational and informational purposes only. They are NOT specific buy recommendations. Trading stocks is risky and you could lose all of your money. Trade at your own risk. Jerry Robinson is not an investment advisor. You should always consult a trusted financial services professional before making any financial or investment decisions. READ FULL DISCLAIMER.

The average American family has three income streams: 1. Husband’s job; 2. Wife’s job; 3. Interest-bearing CD or savings account. This is a scary way to live, especially in the age of outsourcing and computerizing tasks.

The average American family has three income streams: 1. Husband’s job; 2. Wife’s job; 3. Interest-bearing CD or savings account. This is a scary way to live, especially in the age of outsourcing and computerizing tasks.

Tom Cloud joins us for the latest in the gold and silver markets and shares some of the fundamental and technical factors that are affecting prices right now.

Tom Cloud joins us for the latest in the gold and silver markets and shares some of the fundamental and technical factors that are affecting prices right now.  -3.99%

-3.99% 4.99%

4.99%