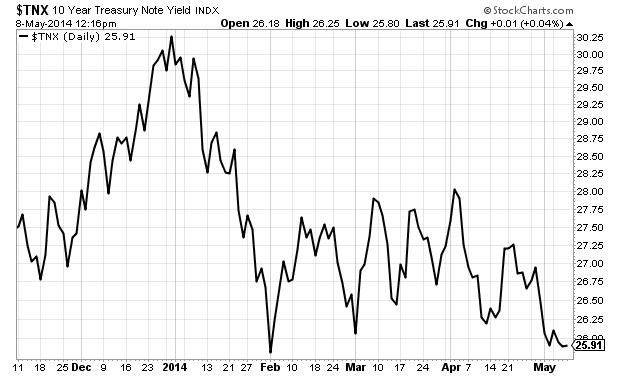

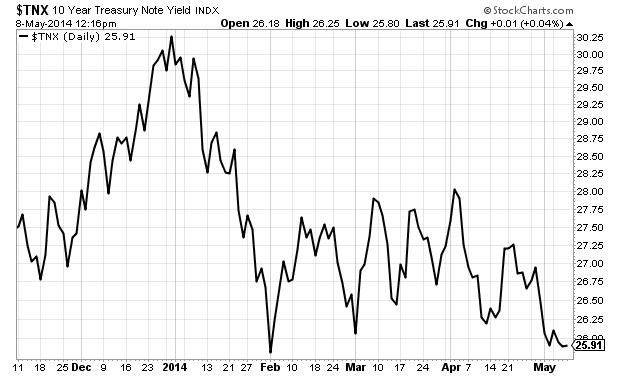

While U.S. stocks are at all-time highs, the U.S. 10-year Treasury yield is near all-time lows. Of course, the Federal Reserve monetary policy is the main reason for this, keeping interest rate targets artificially low in order to pump more money into the U.S. economy. And even though Fed chair Janet Yellen has mentioned raising rates in the foreseeable future, yields continue to stay low. Take a look at the six-month yield chart for 10-year Treasuries.

While U.S. stocks are at all-time highs, the U.S. 10-year Treasury yield is near all-time lows. Of course, the Federal Reserve monetary policy is the main reason for this, keeping interest rate targets artificially low in order to pump more money into the U.S. economy. And even though Fed chair Janet Yellen has mentioned raising rates in the foreseeable future, yields continue to stay low. Take a look at the six-month yield chart for 10-year Treasuries.

Six-Month Performance of 10-Year Treasuries

If you believe the 10-year Treasury yield is due for a run up, a popular online bank, Everbank, is offering a unique opportunity to potentially earn beyond any upside growth in the 10-year Treasury yield. The new product is an FDIC-insured Certificate of Deposit (CD) that tracks the 10-year Treasury yield with a 3.3 upside leverage factor.

Here is how it works: If the 10-year Treasury yield goes up over the next five years, Everbank will take all of the upside growth during the CD term and multiply it by their 3.3 leverage factor to determine the net return. The unique feature of this “MarketSafe CD” is that the deposited principle will always be fully protected in the event there’s a decline in the 10-year Treasury yield (assuming you do not withdraw the principle before maturity of 5 years). Let’s break these features down.

- 3.3 upside leverage factor

- Unlimited upside potential

- 100% safe principle deposit

If you expect the 10-year Treasury yield to grow over the next five years, this CD is definitely worth a closer look, as any upside growth during the CD term will be multiplied by 3.3. Even if the yield goes down, you’ll still recoup all deposited principal. See Everbank’s website for all the details and payout examples.

June 11, 2014 is the deadline for funding the MarketSafe Treasury CD with Everbank.

No periodic rate of interest or annual percentage yield is paid on the CD, and there are no account fees for the CD. The minimum deposit is $1,500, and early withdrawal is not permitted on this CD, so you should not deposit your money in this CD if you do not have the intent or ability to keep your deposit in this CD for the full 5 years.

Lastly, be sure to perform your own due diligence and consult a trusted financial advisor before making any financial decisions. You can visit Everbank’s website here.