In this special guest interview, Faber provides his current view of the financial markets, shares some uncommon wisdom on investment allocation, and explains his popular sector ETF rotation strategy. Faber also offers a free copy of his latest book for all of our listeners (Keep reading to learn how you can get your free copy.)

Later in the program, Jerry Robinson breaks down all of the the basic stock market sectors in the S&P 500 index and explains how he personally uses Faber’s sector ETF rotation strategy to consistently beat the markets.

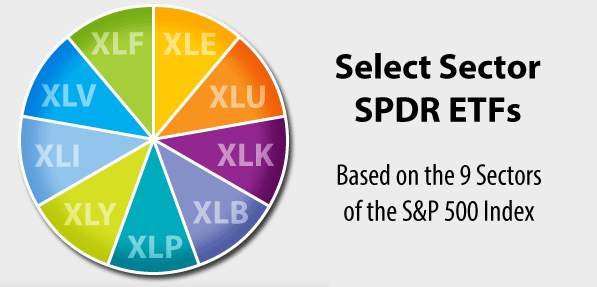

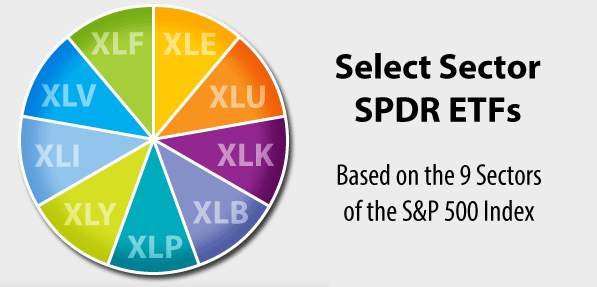

– A stock market sector list of ETFs based on the nine basic stock market sectors included in the S&P 500 index…

– How to use Meb Faber’s simple sector ETF rotation strategy to beat the market 70% of the time…

RESOURCES MENTIONED IN THIS EPISODE

– Global Asset Allocation by Meb Faber – FREE EBOOK DOWNLOAD

– Relative Strength Strategies for Investing – FREE WHITE PAPER DOWNLOAD

– FTMDaily on Youtube

– FTMDaily on Twitter

– Bankruptcy of our Nation (Book)

– Today’s Sponsor, Tom Cloud, provides a FREE Precious Metals Investor Kit – Download Now

2015 Market Insights: An Interview with Meb Faber

MEB FABER is a co-founder and the Chief Investment Officer of Cambria Investment Management and currently manages Cambria’s ETFs, separate accounts and private investment funds. Faber has authored numerous white papers and several investment books: Shareholder Yield, The Ivy Portfolio, and Global Value. He is a frequent speaker and writer on investment strategies and has been featured in Barron’s, The New York Times, and The New Yorker.

MEB FABER is a co-founder and the Chief Investment Officer of Cambria Investment Management and currently manages Cambria’s ETFs, separate accounts and private investment funds. Faber has authored numerous white papers and several investment books: Shareholder Yield, The Ivy Portfolio, and Global Value. He is a frequent speaker and writer on investment strategies and has been featured in Barron’s, The New York Times, and The New Yorker.

In today’s interview, Faber provides his latest insights on the global financial markets and shares where he is investing his own money.

In addition, Faber talks about the recent Chinese stock market rally and explains his popular sector ETF rotation strategy that has been shown to beat overall market returns 70% of the time.

Related LinksMeb Faber Research

Cambria Investments (Money Management)

Cambria Funds (ETF Site)

The Idea Farm

Stock Market Sector List – Basic Stock Market Sectors

A few years ago, I stumbled across an interesting white paper entitled Relative Strength Strategies for Investing written by Meb Faber of Cambria Investment Management. The paper demonstrated a powerful (but simple) investment strategy that outperformed the typical “buy-and-hold” strategy nearly 70% of the time.

Faber’s research, which was based upon 80+ years of stock market data, revealed an astoundingly simple way to beat the market. Put simply, the strategy involves buying sector-based ETFs that have recently outperformed their peers.

Instead of simply buying an S&P 500 index fund, like SPY, this strategy shows how to beat the return of the S&P by investing in the underlying sectors displaying the most relative strength.

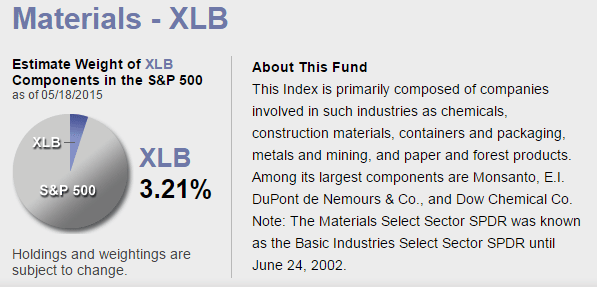

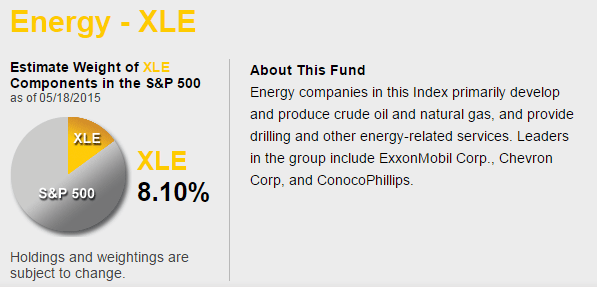

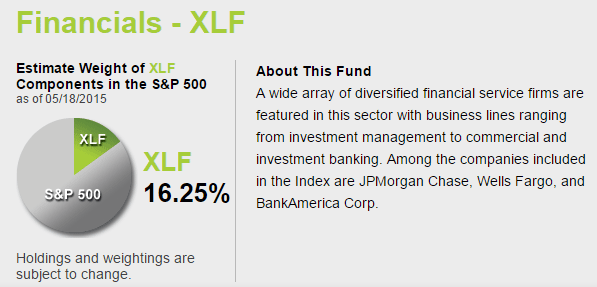

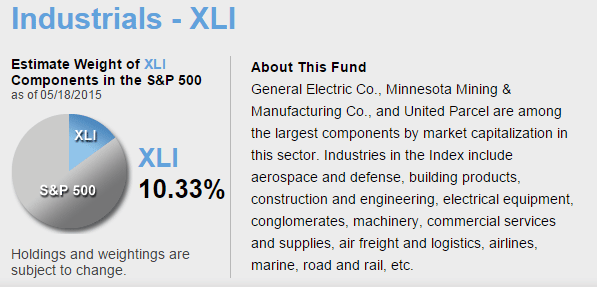

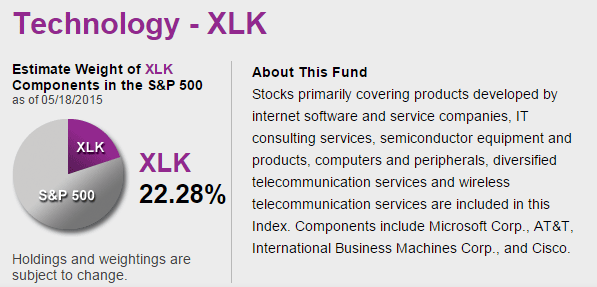

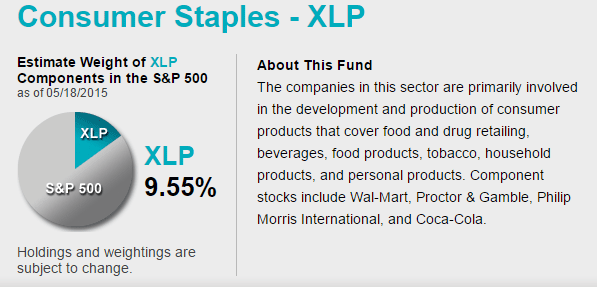

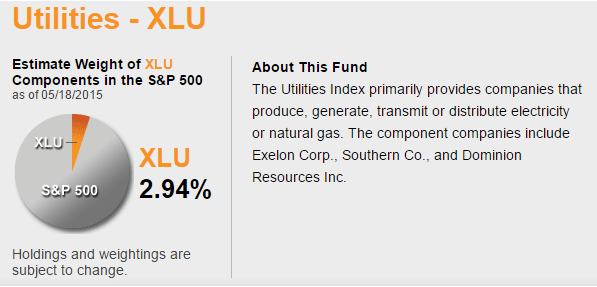

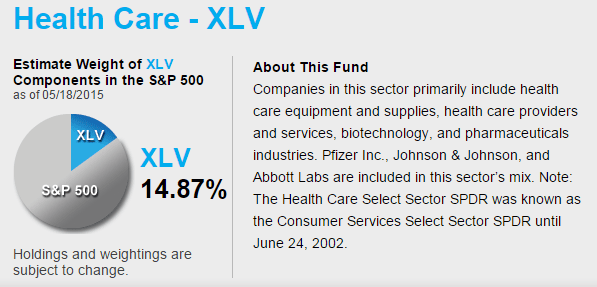

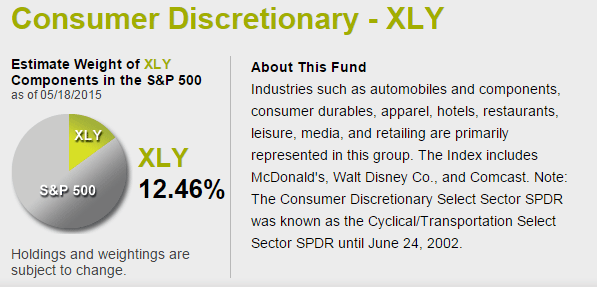

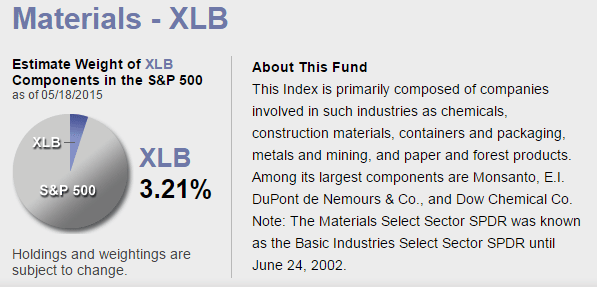

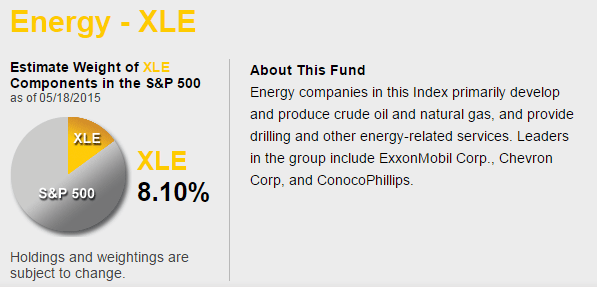

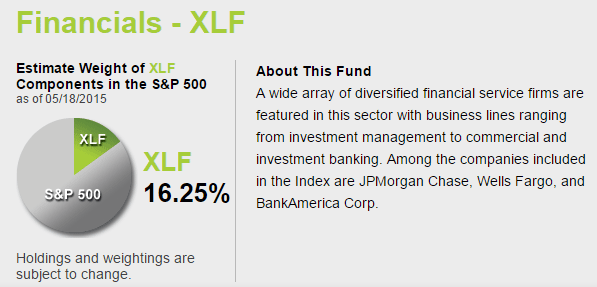

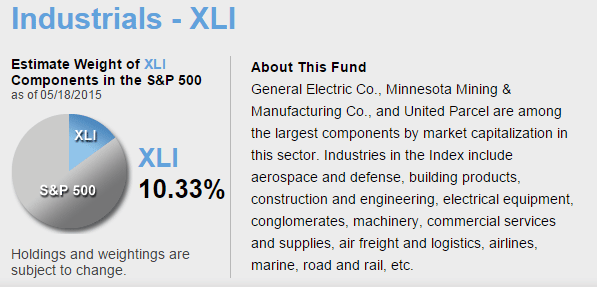

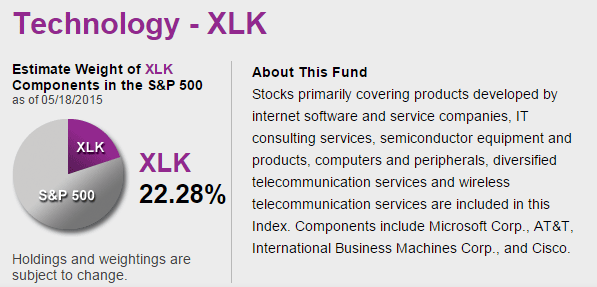

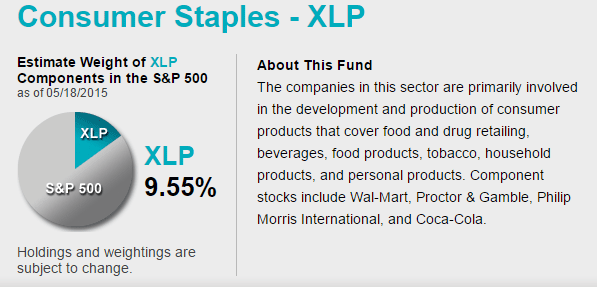

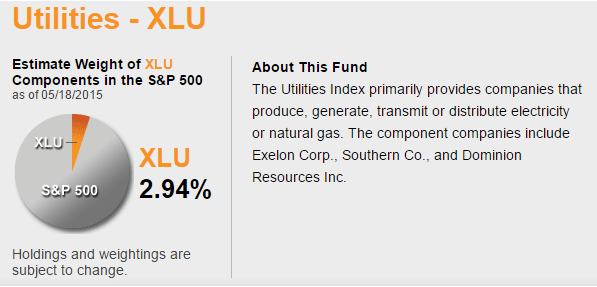

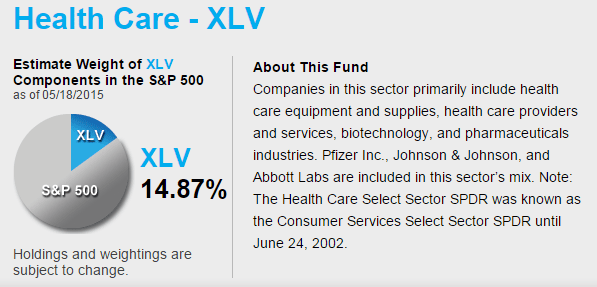

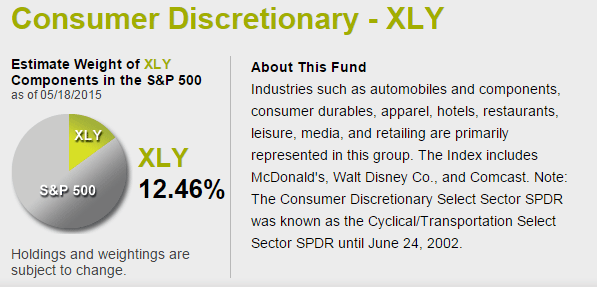

Below, I have provided a stock market sector list (courtesy of State Street Global Advisors)

How This Sector ETF Rotation Strategy Works

The S&P 500 Index is composed of the above nine sectors. Of course, some sectors outperform others each month, each quarter, and each year. Faber’s sector rotation strategy is quite simple. The strategy basically invests in the top 1, 2, or 3 sectors based upon trailing total returns including dividends.

By focusing your investments into the top performing sectors within the S&P 500, you are more likely to own more of the leaders and less of the laggards in the stock market. This, in turn, can boost your returns if the current uptrend continues in your selected sector(s).

Faber’s strategy is also very flexible in that you can invest in the top 1, 2, or 3 sectors and you can rebalance them every month, quarter, six months, or every year. So, it can suit most people’s schedules and temperments.

If you choose to only invest in the top performing sector, then you would basically invest 100% into that sector.

If you instead choose to invest in the two best performing sectors, then you would invest 50% into each of the top two sectors. (While investing in the two (or three) top sectors slightly lowers the historical return probability, it also slightly lowers your risk through wider diversification.)

And if you choose to invest in the top three performing sectors, your investment would be divided evenly into thirds, that is 33% invested in each of the top three sectors.

How often do you rebalance the portfolio? That is up to you. You can do it every month, quarter, six months, or once a year. Faber’s research does reveal, however, that certain timeframes are more ideal than others.

As you can see, it is a very simple investment strategy that is easy to implement and has historically beaten the underlying index returns 70% of the time.

If this simple sector ETF rotation strategy sounds interesting, I urge you to download and read Faber’s 22-page White Paper here. It’s a quick read and contains some interesting insights, especially regarding how to optimize the portfolio for the best possible returns. Also, you should know that Faber’s paper is based upon a different index than the S&P 500. But that’s okay, as the strategy can be applied not only to any typical stock index, but to foreign stock markets and other asset classes.

NOTE: I have personally been using this sector ETF rotation strategy for nearly two years and have been very pleased with the results. I personally choose to rebalance my sector ETF investments every quarter and am now sharing which sector(s) I am buying with our FTM Insiders and Platinum member community. If you would like access, you can learn more here.

New! Premium Precious Metals Weekly Charts!

While gold, silver, palladium, and platinum have all suffered in recent years, we believe that the current downtrends will eventually end and give way to a new major uptrend.

As we anticipate these new uptrends, FTMDaily has begun providing weekly precious metals trend analysis to all of our FTM Insiders and Pro Traders.

Our weekly trend analysis on gold, silver, palladium, and platinum will keep you “in the know” on the metals. You will know the current trend at all times.

And when the new major uptrend begins, you will know immediately.

This means more profits and a better entry price for the next leg up.

You can learn more specifics about our new precious metals trend analysis here.

Related LinksCHART: Gold Prices Strengthen As Major Buy Signal Looms

PREMIUM: Precious Metals Trends/Charts

Free Precious Metals Investing Resources

Here at FTMDaily, we believe that gold and silver are the best forms of money. We also believe that the current paper money system is going to eventually implode due to unsustainable debt levels. The beneficiaries of such an implosion would include hard assets like precious metals, commodities, and other tangible investments.

Most Americans have never purchased investment grade precious metals. FTMDaily seeks to inform the public on the benefits of owning precious metals. We have created many educational resources that will help any investor — whether novice or advanced — to better understand how to buy gold at the best time, and at the best price.

Precious Metals Links

Sign up for Tom Cloud’s Precious Metals Investing E-News AlertsEducationPrecious Metals – Investor Education (Free Videos, Reports, Articles)

Real-Time Gold Price, News, and Commentary

Premium Gold Trend Analysis – Includes Buy Signals

Real-Time Silver Price, News, and Commentary

Premium Silver Trend Analysis – Includes Buy Signals

Real-Time Palladium Price, News, and Commentary

Premium Palladium Trend Analysis – Includes Buy Signals

Real-Time Platinum Price, News, and Commentary

Premium Platinum Trend Analysis – Includes Buy Signals

Current Specials

THANKS FOR LISTENING!

Thanks for joining me again this week. Have something you’d like to share with me or one of our guests? Leave a note in the comment section below!

If you enjoyed this episode, please share it on Facebook, Twitter, and any other social media outlets. Help us spread the word!

Also, please leave an honest review for Follow the Money Weekly on iTunes! Ratings and reviews are extremely helpful and greatly appreciated! They do matter in the rankings of the show, and I read each and every one of them personally.

Thank you for your support! See you next week!

Recent Podcasts by Jerry Robinson

incoming searches: sector rotation etf, ETF rotation strategy, basic stock market sectors, stock market sector list

MEB FABER is a co-founder and the Chief Investment Officer of Cambria Investment Management and currently manages Cambria’s ETFs, separate accounts and private investment funds. Faber has authored numerous white papers and several investment books: Shareholder Yield, The Ivy Portfolio, and Global Value. He is a frequent speaker and writer on investment strategies and has been featured in Barron’s, The New York Times, and The New Yorker.

MEB FABER is a co-founder and the Chief Investment Officer of Cambria Investment Management and currently manages Cambria’s ETFs, separate accounts and private investment funds. Faber has authored numerous white papers and several investment books: Shareholder Yield, The Ivy Portfolio, and Global Value. He is a frequent speaker and writer on investment strategies and has been featured in Barron’s, The New York Times, and The New Yorker.