How to Use Our Momentum Stock Leaders List

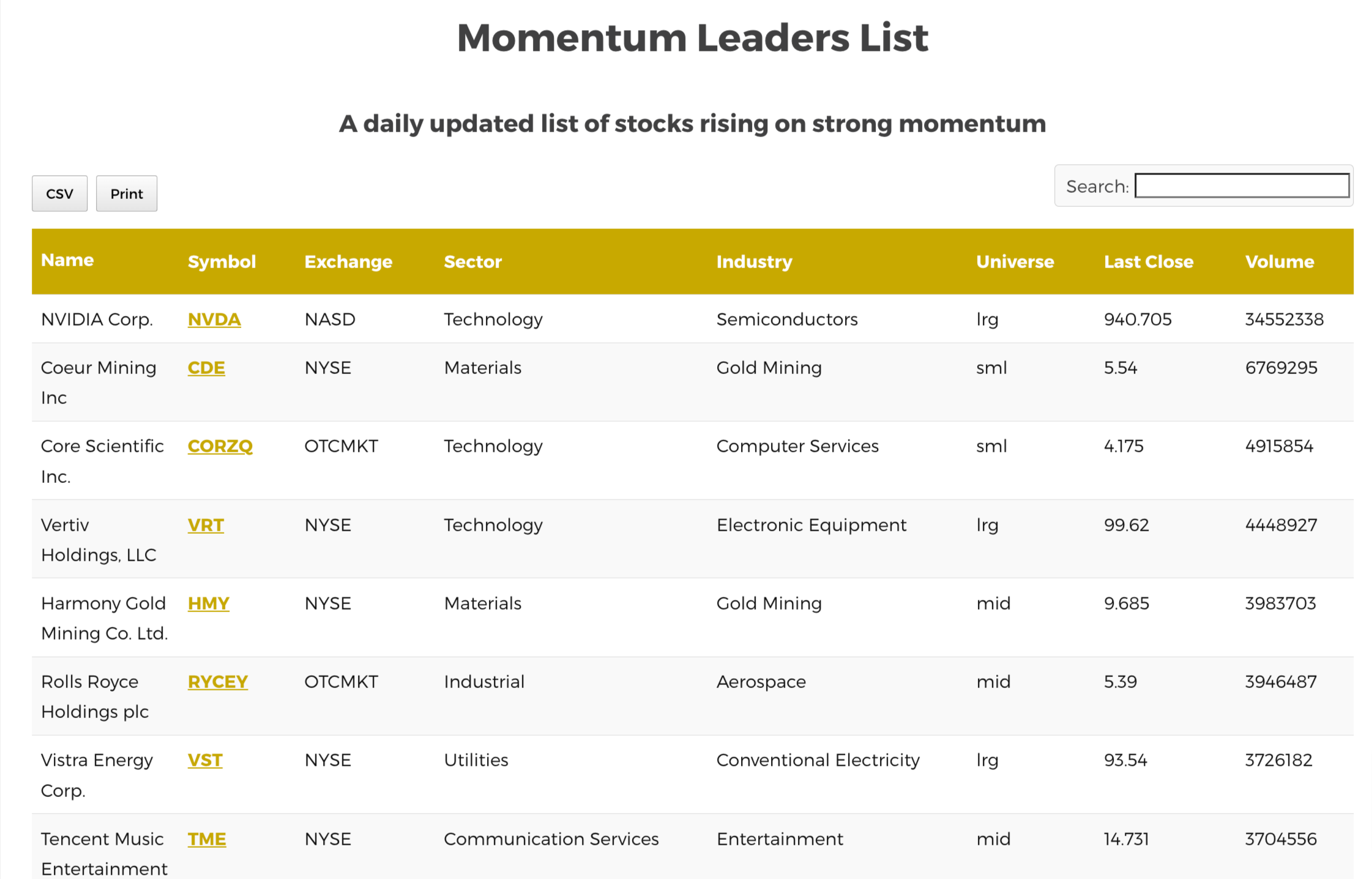

There are usually dozens of stocks and ETFs on this list, and we update it every day so that members get the latest data for their trading and investing research.

In this simple video presentation, I spent some time sharing how our members have been successfully using this unique Momentum-focused stock list.

Specifically, I laid out several short-term trading strategies that traders of all types can use to profit from this list.

I shared several strategies for swing traders, day traders, and even scalpers.

So too, many of our members report successfully using this list by combining it with our sector rankings research.

Each week, they will check our Swing trend sector rankings here (which we update every weekend) and then focus their short-term trading on stocks/ETFs in the leading sectors from our Momentum Leaders list here.

For example, let’s say the top-ranked sector right now is the Technology sector. Swing traders can sort our Momentum Stock Leaders list by Sector and filter down to only the Technology stocks. Once you’ve narrowed your list down, you can then focus on just a handful of momentum stocks for further trading consideration. With nearly 6,000 available stocks in the United States alone, many aspiring traders know that half the battle is narrowing down your list of stocks to trade!

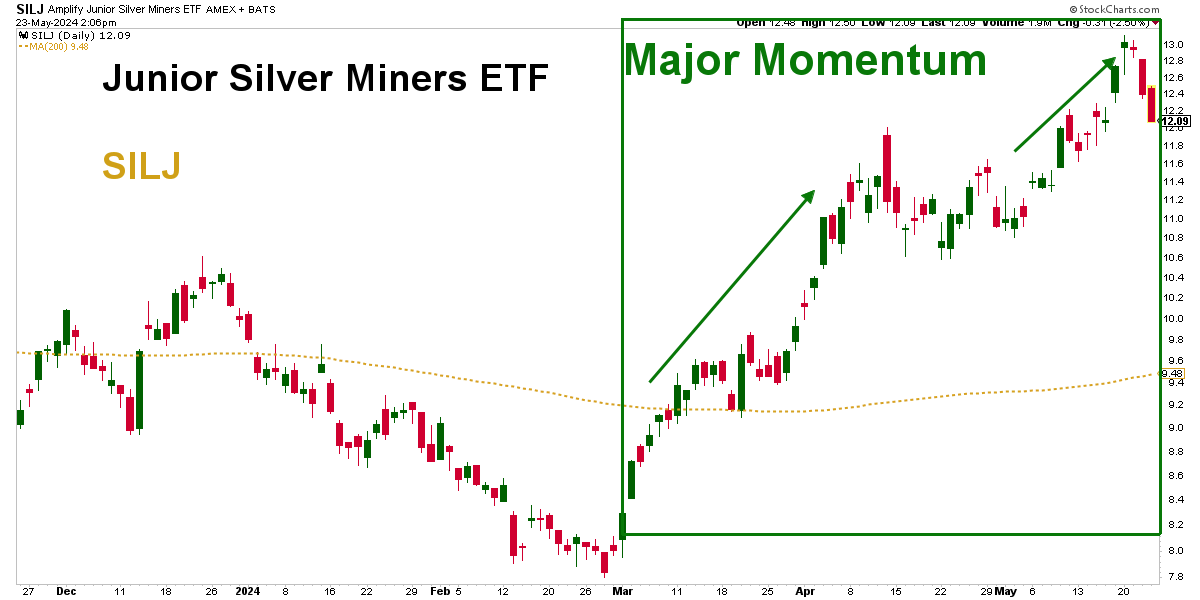

Smart traders know the way to win in the markets is to stay on the right side of the trend.

And traders especially like stocks that are not only in confirmed uptrends but that are also moving on strong momentum.

If you are new to us here at Follow the Money, try combining our two powerful member services: Sector Rankings and Momentum Stock Leaders.

If you are an experienced trader in search of new short-term trading ideas, you can find many great potential trading setups this way! |