SHOW NOTES – 8/26/14

Stocks Soar as Bankrupt U.S. Economy Stagnates

Plus, an update for precious metals investors

by Jerry Robinson

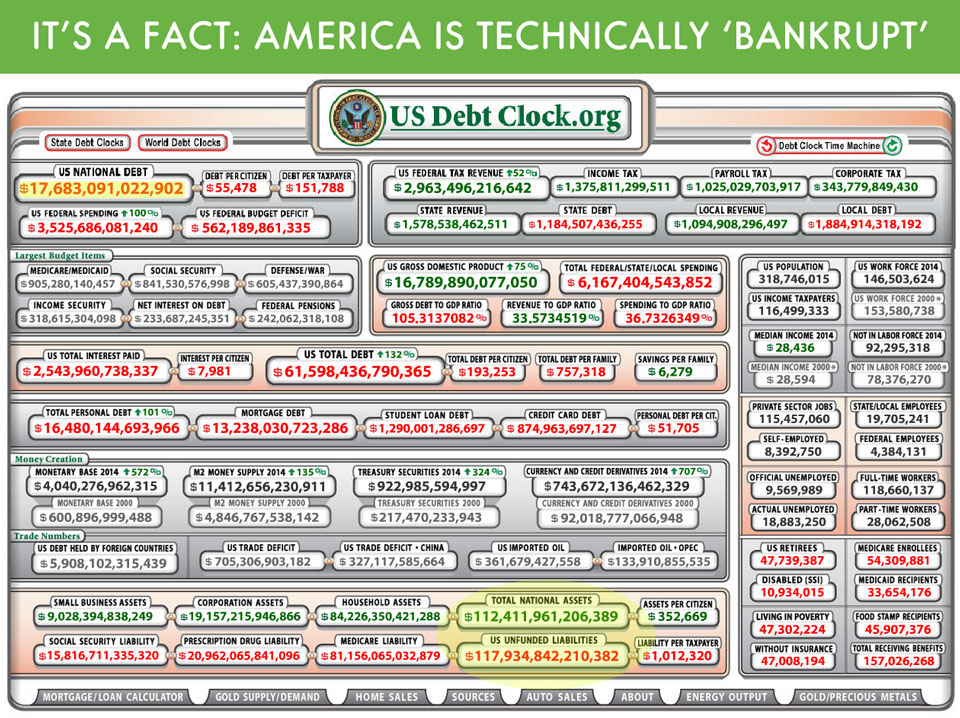

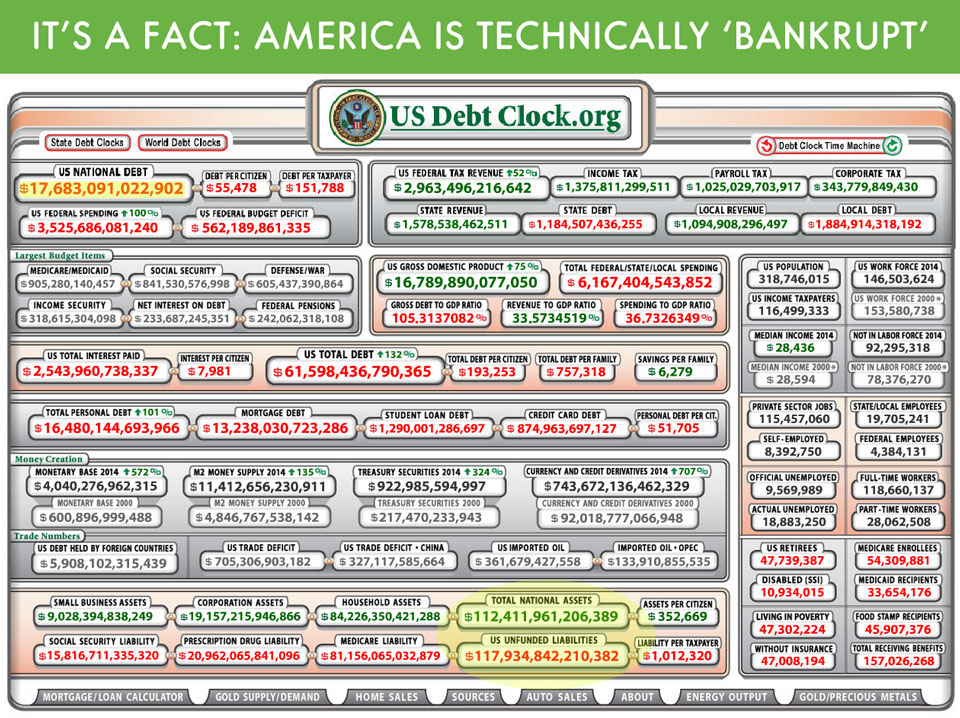

FTMDaily.com – Despite years of economic “pep” talks by the political windbags that carouse the streets of Washington D.C., the facts remain clear. (Stubborn things, those “facts.”) Put simply, the U.S economy is bankrupt.

Simply subtract America’s unfunded liabilities from the total amount of all of the nation’s assets and…

The answer: America is still left with a deficit of $5.5 trillion!

But our nation’s lack of sound financial stewardship has not just devastated our government… It has decimated our citizens.

As of the end of 2012, 35.4% of the U.S. population was receiving some form of means-tested benefit payments from the Federal government. Meaning, 109,631,000 Americans were receiving some kind of welfare payment from the Federal government in late 2012.

Do you think that number has gone down since 2012?

The numbers break down like this:

82,679,000 of the welfare-takers lived in households where people were on Medicaid, said the Census Bureau.

51,471,000 were in households on food stamps.

22,526,000 were in the Women, Infants and Children program.

20,355,000 were in households on Supplemental Security Income.

13,267,000 lived in public housing or got housing subsidies.

5,442,000 got Temporary Assistance to Needy Families.

4,517,000 received other forms of federal cash assistance.

CNSNews adds:

“When those receiving benefits from non-means-tested federal programs — such as Social Security, Medicare, unemployment and veterans benefits — were added to those taking welfare benefits, it turned out that 153,323,000 people were getting federal benefits of some type at the end of 2012.”

Considering America’s 309 million citizens in late 2012, this means that one out of every two American citizens is getting a check from the U.S. Federal government!

No amount of monetary wizardry emitting from the Federal Reserve will be able to suspend reality indefinitely.

While I have long been enjoying the rising U.S. stock market (check out our daily stock trading service here), I also know that the ride up will not last forever.

Prepare yourself with wise diversification in your savings, your investments, and your income.

Mankind’s flirtation with fiat paper currency systems throughout history have all ended the same.

Do you think the Federal Reserve is special or inherently any different from the myriad of similar, yet more crude, attempts that failed before it?

It is not immune to the basic laws of economics.

In fact, I think it is fair to say that the Fed’s reputation among future generations will be colored by the institution’s sheer arrogance and mind-numbing levels of hubris. In retrospect, the reason and nature of it’s demise will be openly plain and obvious.

Sadly, the time-tested financial wisdom that occurred naturally to our forefathers has been stifled and distorted by our modern debt-based monetary system…

Listen to the podcast for Jerry Robinson’s full, in-depth commentary.

Other Links of Interest This Week

U.S. WAGES DOWN 23% SINCE 2008 (Breitbart)

U.S. Bank Profits Near Record Levels (WSJ)

Market watchdog warns on danger of cyber attack (Financial Times)

The seven drivers of the gold price (The Telegraph-UK)

U.S. Gives Intelligence To Assad For Targetting Isis Commanders (IBT)

Isis surges towards the borders of Turkey as west mulls options (The Observer)

Shanghai to San Francisco in 100 minutes by Chinese supersonic submarine (South China Morning Post)

China hosts largest ever military drill with Russia, other SCO nations (RT)

An Update for Precious Metals Investors

Tom Cloud – Precious Metals Advisor

Tom Cloud joins us for the latest in the gold and silver markets and shares some of the fundamental and technical factors that are affecting prices right now.

Tom Cloud joins us for the latest in the gold and silver markets and shares some of the fundamental and technical factors that are affecting prices right now.

Free Precious Metals Investing Resources >>

Click here for over 10 hours of free precious metals investing educational resources >>

Trigger Trade Report

Next, Jennifer Robinson is here to update our FTM Insiders on Trigger Trading activity for the past two weeks. We’ve had two stocks stop out since the last update for Trigger Traders: SH for a 2.97% loss and GDX for a 4.77% loss. We currently have 10 stocks in play in the markets! BRCD is up over 7%, MAR is up 2.5%, SIRI is up 2.25% from its trigger price, and WWAV is up over 4%. Three other stocks are up over 2%: UDR, AVT, and NHI. We are looking forward to locking in some of these gains in the coming days. We are still awaiting Jerry’s trigger price on four other stocks.

Recent Trigger Trade Performance

| Ticker | Buy Date | Buy Price | Sell Date | Sell Price | Days Held | Profit/Loss % |

| GDX | 8/8/14 | $27.05 | 8/25/14 | $25.76 | 12 |  -4.77% -4.77% |

| SH | 7/31/14 | $23.57 | 8/21/14 | $22.87 | 16 |  -2.97% -2.97% |

| SA | 8/8/14 | $9.93 | 8/11/14 | $9.54 | 2 |  -3.93% -3.93% |

| OFC | 7/9/14 | $28.55 | 8/6/14 | $27.48 | 21 |  -4.02% -4.02% |

| MDLZ | 7/8/14 | $38.36 | 7/31/14 | $36.92 | 18 |  -5.13% -5.13% |

| KMT | 7/22/14 | $46.64 | 7/30/14 | $44.25 | 7 |  -3.76% -3.76% |

| TXT | 7/16/14 | $39.06 | 7/28/14 | $37.49 | 9 |  -3.75% -3.75% |

| EBAY | 7/3/14 | $51.02 | 7/24/14 | $53.19 | 15 |  4.25% 4.25% |

| DUK | 6/18/14 | $72.01 | 7/24/14 | $73.99 | 26 |  2.74% 2.74% |

| SYMC | 6/26/14 | $22.61 | 7/23/14 | $23.43 | 20 |  3.62% 3.62% |

View More Stock Trading Performance Results >>

Recent Podcasts by Jerry Robinson

DISCLAIMER: The above trading ideas are from my own personal stock watchlist and are for educational and informational purposes only. They are NOT specific buy recommendations. Trading stocks is risky and you could lose all of your money. Trade at your own risk. Jerry Robinson is not an investment advisor. You should always consult a trusted financial services professional before making any financial or investment decisions. READ FULL DISCLAIMER.

-4.77%

-4.77% 4.25%

4.25%