Over the next several days, I will be explaining my financial philosophy when it comes to the following:

– Savings diversification (Diversifying your liquidity)

– Investment diversification (Diversifying your investment dollars across a wide variety of asset classes)

– Income diversification (Creating multiple streams of income into your financial life)

In yesterday’s column, I focused specifically on the need to diversify your liquid savings. (You can read yesterday’s article here.)

I referred to this as the Diversified Six-Month Liquid Savings strategy, in short, DSL Savings™.

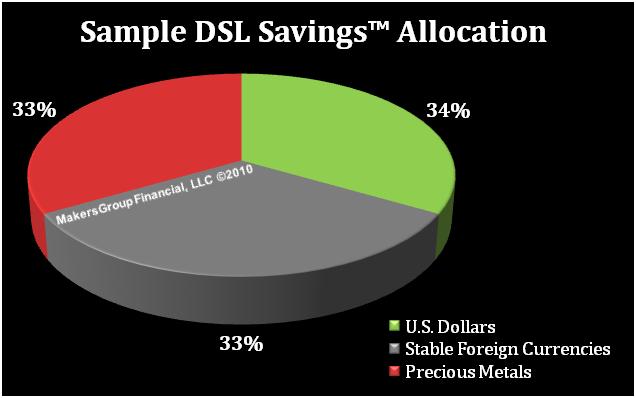

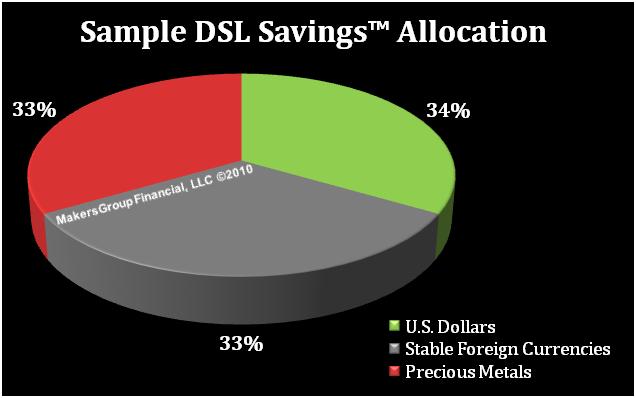

I concluded by giving you a sample DSL strategy that I personally use, and that was documented in my book, Bankruptcy of our Nation, which breaks your six month liquid savings into thirds – using foreign currencies, precious metals, and U.S. Dollar denominated assets.

Assuming that your 6 months of liquid savings equals $15,000, then this strategy would look something like this below.

• One-third ($5,000) in U.S. dollars (i.e. savings account, money market, cash-value life insurance, etc.)

• One-third ($5,000) in a stable foreign currency or a stable basket of currencies

• One-third ($5,000) in precious metals (i.e. gold and silver)

While using these three asset classes is not the only diversification strategy for your DSL savings reserve, I have personally found it to be particularly effective in protecting purchasing power. In fact, in late 2009, we hired financial analysts to test this strategy using historical data.

The analysts used the sample allocation strategy described above on the following time periods:

- A 5 year back-test (2004 – 2008)

- A 10 year back-test (1999 – 2008)

- A 19 year back-test (1990 – 2008)

They also had a control test for each time period that compared our DSL Savings™ strategy to a typical savings account. In this test, the savings were not diversified, but rather all savings dollars were placed into U.S. treasury bills receiving the 3 month T-bill rate. The purpose of the control test was to determine whether a person using DSL™ Savings would have accumulated more money over each time period than a person keeping all savings in a U.S. dollar-denominated savings account.

Our findings were completely stunning.

The first results you will see represent the control group, which used only Treasury bills. The relevant measure used in our study was the total return on savings after inflation. Also, all interest earned during a particular year was assumed to be reinvested back into the Treasury bills. The results are shown in the table below.

|

Time Period

|

% Return on Non-diversified Savings (after inflation) |

| 2004 – 2008 |

-2.99% |

| 1999 – 2008 |

-0.49% |

| 1990 – 2008 |

13.18%

|

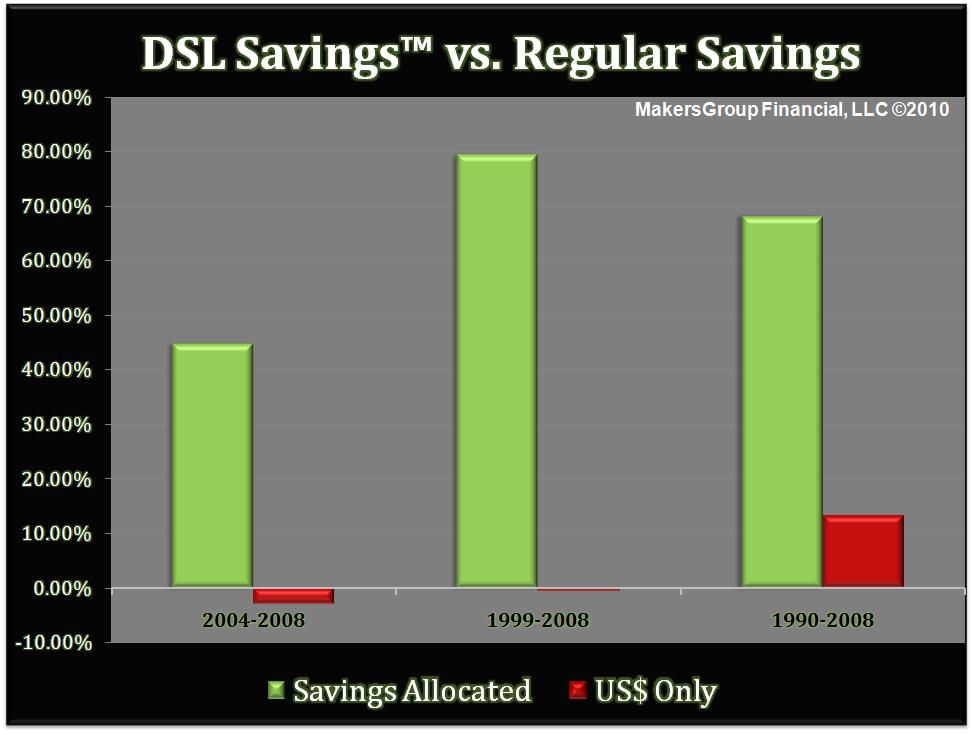

Notice that the only positive return (13.18%) in the non-diversified savings strategy occurred in the 19-year time period, from 1990 to 2008. But the total return for the other two periods was negative.

How can this be if the rate of return for a T-bill was never negative?

Simply put… inflation. Inflation is a major eroding factor on money, and although the savings dollars in the non-diversified strategy are earning interest, these returns are counteracted by the effects of inflation, which actually causes the purchasing power of the savings account to fall below the original principal amount in real terms.

So how did our DSL™ Savings Strategy hold up under these same back-testing methods? Let’s take a look.

This next section of results, representing the DSL™ Savings allocation model, simply diversifies the savings account:

- One-third in T-bills

- One-third in stable foreign currencies

- One-third in precious metals

As in the first test, all returns of this separate test were calculated on an after-inflation basis. Additionally, the same time periods used in the control group were used in this test.

The results are shown in the table below.

| Time Period |

% Return on DSL Savings™ (after inflation) |

| 2004 – 2008 |

44.71% |

| 1999 – 2008 |

79.31% |

| 1990 – 2008 |

68.09% |

As you can imagine, we were stunned at the results. We found that the return on DSL™ Savings is well above the return on undiversified savings in every single time period. For example, if we look at the time period of 2004 -2008, the return on undiversified savings is -2.99%, whereas the return on DSL™ Savings strategy is 44.71%!

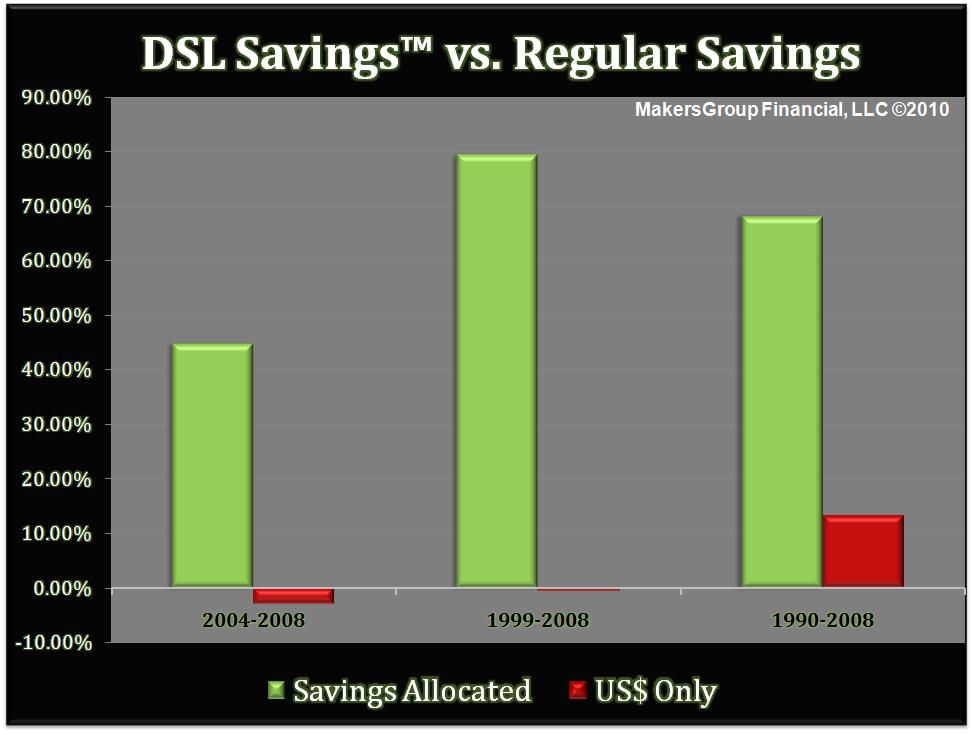

To further visualize the difference that diversification makes in your savings dollars, we have summarized the results in the graph below.

As you can see, the return on DSL Savings™ far exceeds the return for the control group in each of the time period studies. In two of the time periods, the control group actually loses money (after inflation).

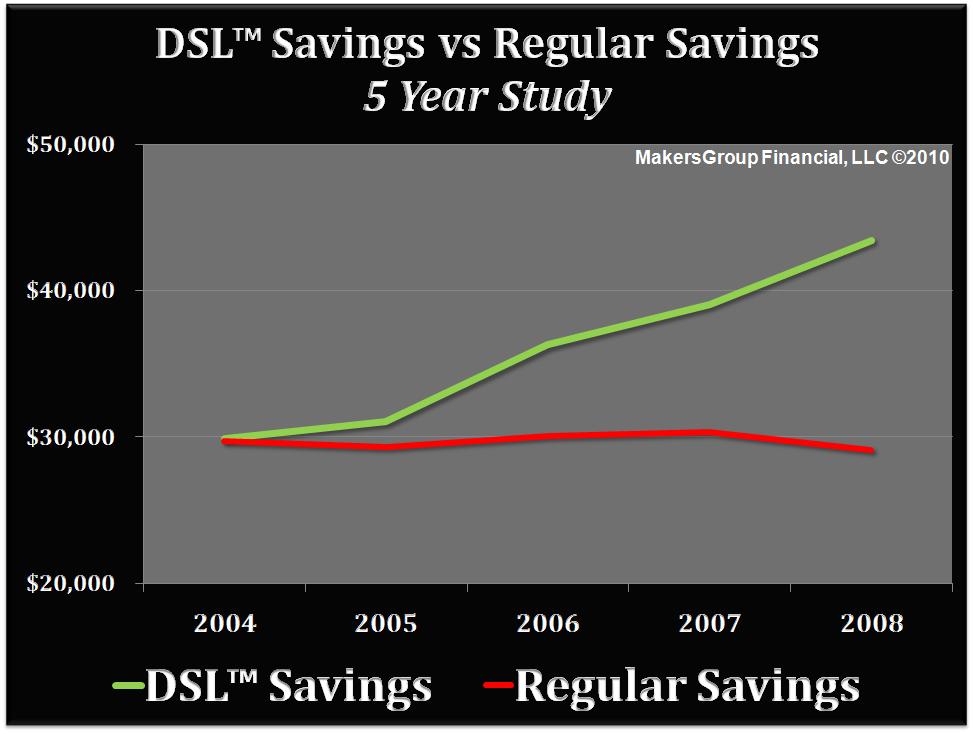

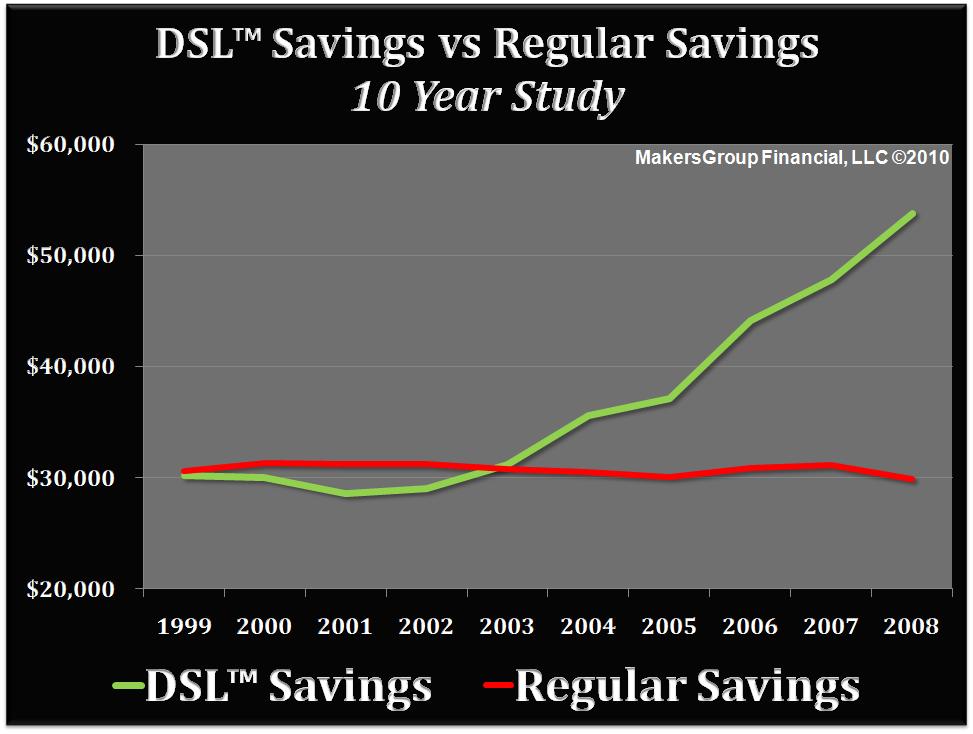

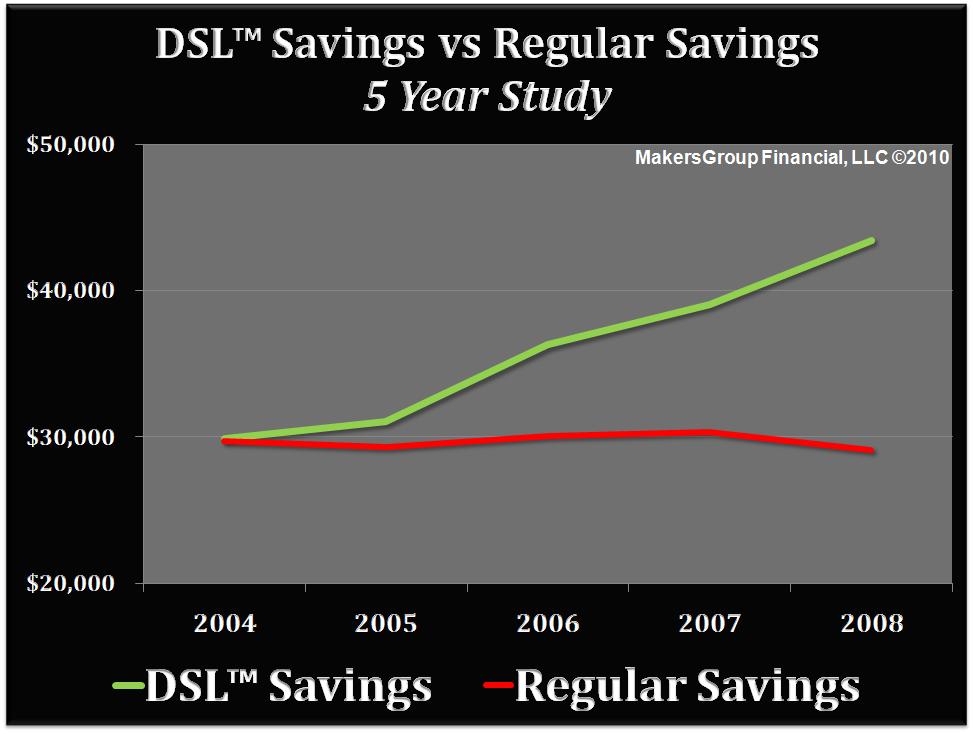

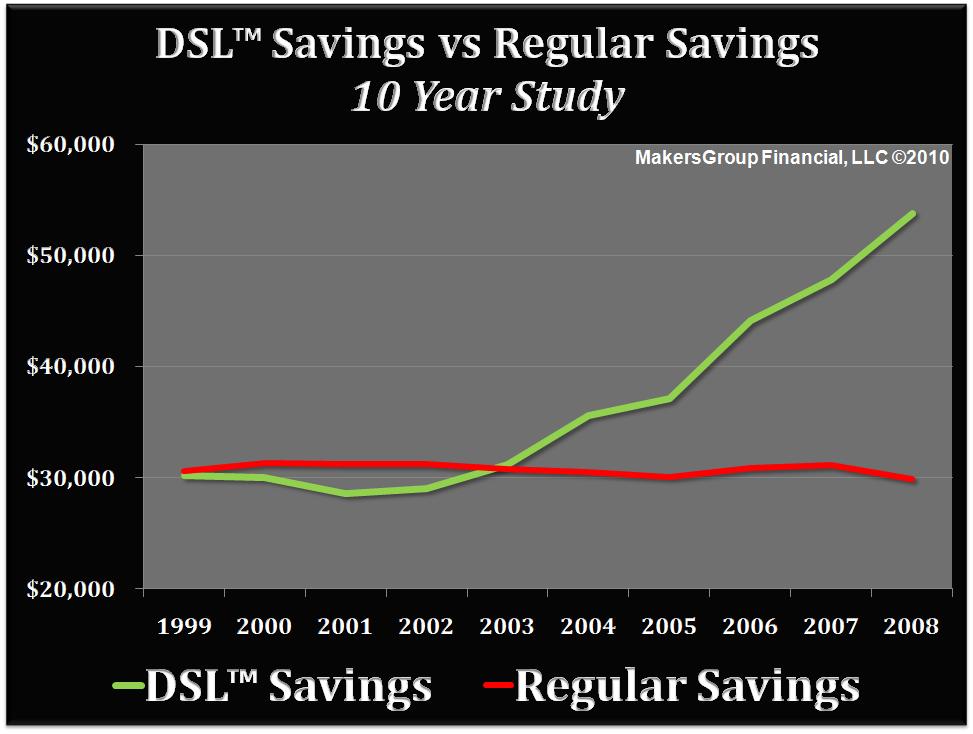

Finally, let’s consider these results from one more angle, shown in the charts below.

The above graphs show the total dollar amount in both savings strategies each year over the given time period. The amount in the non-diversified savings remains flat or even drops below the initial amount. Meanwhile, the DSL™ Saving strategy increases over time, not only helping to hedge against inflation, but also earning money on an after-inflation basis! (And isn’t inflation protection what every wise investor is seeking right now?)

Finally, it is important to remember what the DSL™ Savings strategy is, and what it is not. It is a savings strategy. It is not an investing strategy. (We haven’t even breached the topic of investments, although these results show a better return than many other investments.) Thanks to decades of brainwashing from Wall Street and the mainstream financial media, most Americans do not understand the important difference between investing and saving. They are entirely different topics. When this article series moves into the topic of investment diversification, I will take time to explain the important differences.

The bottom line: Based on historical data, diversifying can protect your savings from the eroding power of inflation and can even help grow your savings on an after-inflation basis.

Tomorrow, I will explain which foreign currencies, precious metals, and U.S. denominated asset classes that we personally like here at FTMDaily.com. (Read Part 3 of this series here.)

Here at FTMDaily.com, we are working hard to create solutions for you during these difficult times of economic crisis. We invite your feedback and comments on how we may serve you better.

Until tomorrow,

Jerry Robinson – FTMDaily.com