One of the most common trading catchphrases is to

“Cut your losses short and let your winners run.”

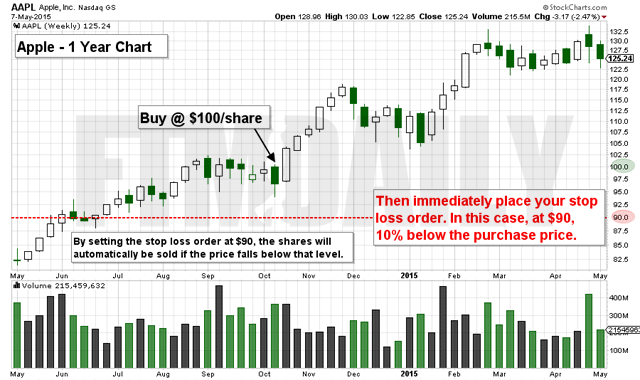

One of the best ways to cut your losses short is using a stop loss order, which instructs your broker to automatically sell your stock if it falls to a price you specify.

We always place a stop loss order based on our max loss threshold immediately after we buy a stock.

Determining where to place your own stop loss order will greatly depend upon your own risk tolerance. My preferred stop loss on a swing trade is between 7%-10%. This means that if the stock were to suddenly fail after I bought it, I would want to limit my potential losses to no more than 10%. Think of it as a form of damage control.

You may also want to use technical indicators, like chart patterns or areas of recent support, to help determine your stop loss.

And while stop loss orders can serve as an excellent way to limit your losses, they are not foolproof and cannot protect you from a sudden gap down in the stock.

For example, let’s assume that you purchase 100 shares of Apple stock on a Monday at $100 per share and place your stop loss at $92. By placing this stop loss order, you have instructed your broker to sell all 100 shares of Apple if it were to trade at $92 per share.

After the market closes on Monday, imagine that terrible news comes out about Apple. Overnight, traders and investors everywhere respond in a state of panic and place sell orders on the stock, causing it to gap down. By the time the stock opens for trading on Tuesday morning, the shares have fallen 20% to $80 per share!

While this may sound like an extreme case you should know that it does happen occasionally. And if it does happen to you, you should know that it is highly unlikely that your stop loss order will protect you from the gap down.

I strongly urge traders, especially new traders, to use stop losses on every single trade.

Happy trading and investing,

Jerry Robinson