In this eighth episode of the BRAND NEW Mid-Week Precious Metals Market Update, Tom Cloud discusses some of the technicals and fundamentals that are impacting gold and silver prices, with exclusive info for FTM Insiders.

[private]

Welcome FTM Insider! You are currently viewing exclusive content. You can return to your Insider Dashboard here.

8/28/2013 – Mid-Week Precious Metals Market Update E08

Download

(Right-click and select ‘Save as’)

Audio Transcript Below

This is Tom Cloud with this week’s midweek precious metals market update.

Possible Invasion of Syria Affects Precious Metals

A lot is going on. Of course, we go straight to Syria, and on Wednesday here, there is a lot of information on the internet predicting an invasion as early as tomorrow. Certainly, Jerry has handled, and done a great job the last two days on keeping you updated on what’s going on in Syria, and what’s behind it.

From my perspective in the metals market, one of these things is we could wake up on Thursday morning and gold could be over $1500 an ounce very quickly. And yet, we will hear some UN resolution to try to keep the thing down. What you have to keep your eyes on now is not just a safe haven buying for war, or the talk about war, but the technicals.

Technicals

We’ve talked about it, Jerry and I have, the last couple of Saturdays. This technical market is set up so beautifully. Once we got to $20.50, I told the listeners to get in. We’ve now seen silver go up to $25 an ounce, and we’ve seen gold, once it got to $1,280, now up to the $1,440 an ounce range.

The question I ask investors as I talk to them every day is, “Do you believe gold and silver will go back to where they started the year?” That’s gold at $1,665 and silver at $30. And even if they say “yes” I say, “What are you waiting on? You’ve got a built-in profit of over 20% in silver and 15% in gold, if it just goes back up to where it started the year.”

Whether it takes one last dip is not important. So, what is important is having the money out of the stock market system where we’ve seen sell signals including the one Jerry gave to come out of a lot of the different stocks. It’s very scary to look and see a stock market that’s gone down a thousand points, and the dollar has dropped 6%, while silver has gone from $18.50 to $25, over a 35% gain in less than a month.

And, these are not just things that are knee jerk reactions. These are moves back in and basically everything they did to get weak hands off of gold and silver they accomplished, and now we see J.P. Morgan long on gold and silver as I put out yesterday’s email blast. To see them both there, and J.P. Morgan selling their vault in New York’s Liberty Square that connects with the Fed’s vault.

Positive Technicals and Fundamentals

So, all this is very, very good news, from both the technical and the fundamental sides, to see them on the long side of gold and silver. But, who wouldn’t be on the long side of gold and silver with everything going on in the world and the equity markets, and also the potential killing fields in bonds that we’ve talked about several times.

So, our advice is to just keep on accumulating and to even accelerate your accumulation, because next week, after we’re closed on Labor Day, on Tuesday, by the time we open, Europe will be back at full strength after their month holiday season in August. Historically, it’s been a very good week for gold and silver when the Europeans return in full force, which will be Tuesday when the market opens there.

There are several economic indicators out there that will be released, the GDP and some others the remainder of the week. They could have a mild affect, or if the GDP was really bad, and the jobs report was really bad, we know they are going to more quantitative easing then, and we won’t hear anymore talk about tapering.

The Goal

So, in closing, I just want to say that you’ve gone from a month ago when everybody in the world was scared gold was going to $750, and silver was going to go down to $10, to now when everybody in world wants to buy it. It just shows you how fickle our job is to just keep you from getting too high or too low, just keep your eye on the ball.

The goal is to get out of paper money because there is not any good ending that could possibly come from paper money in the near future. It’s absolutely zero. The derivatives have taken care of that and the risk is just too high. So, you just have to be conservative with your paper investments and keep moving your money into real assets that have value.

If any of you need to talk to me, you can reach me at 800-247-2812. And, if you don’t have a precious metals IRA, if you have money in an IRA, you need to also talk to me about getting some into a precious metals IRA, and we can discuss that with you as well.

With this week’s midweek precious metals market update, this is Tom Cloud signing out.

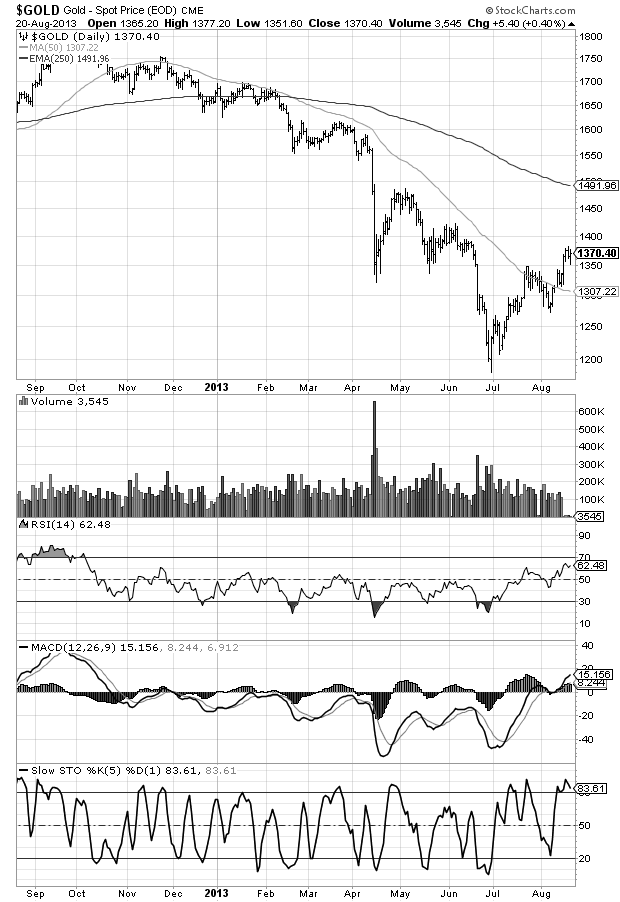

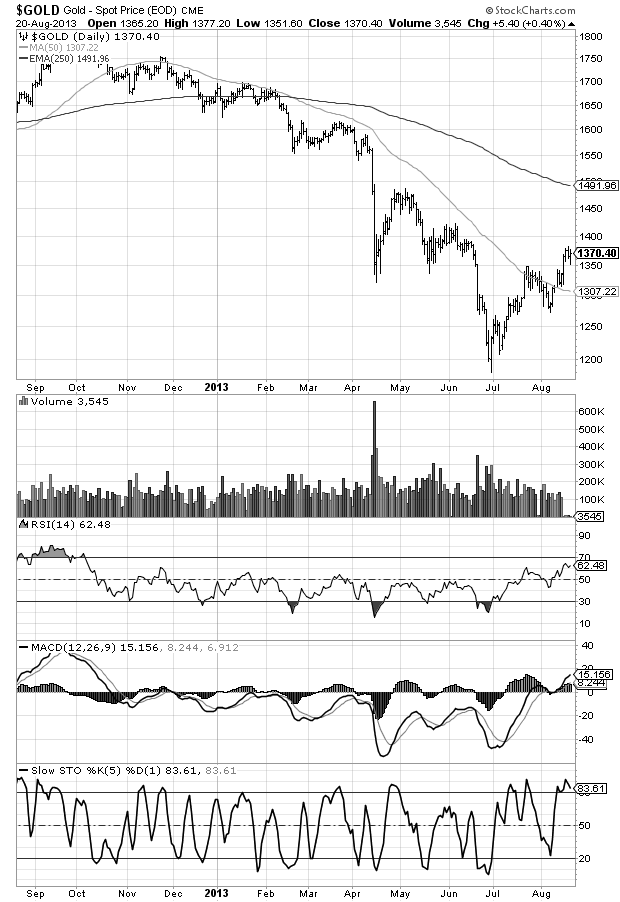

One Year Gold Chart

With technical indicators

One Year Silver Chart

With technical indicators

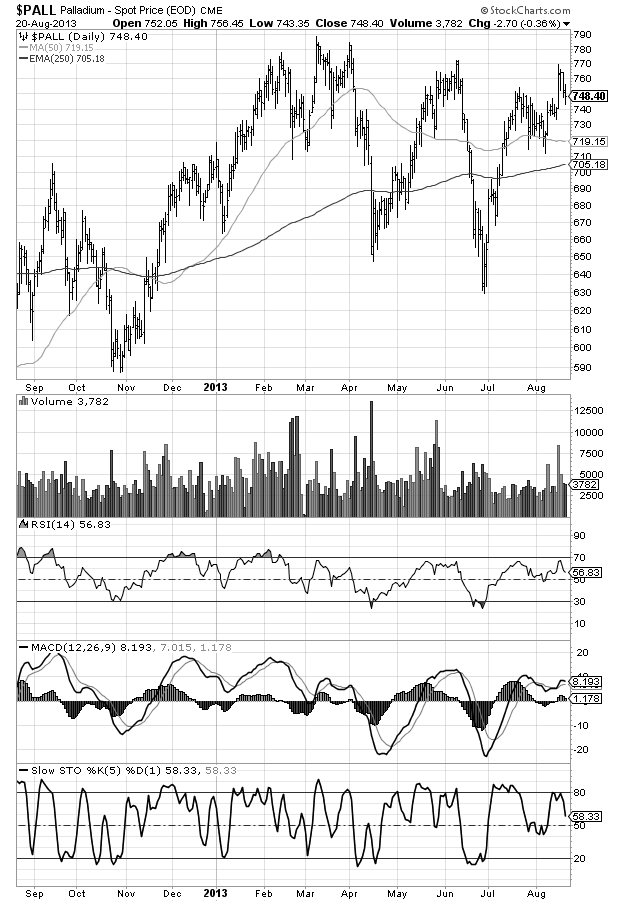

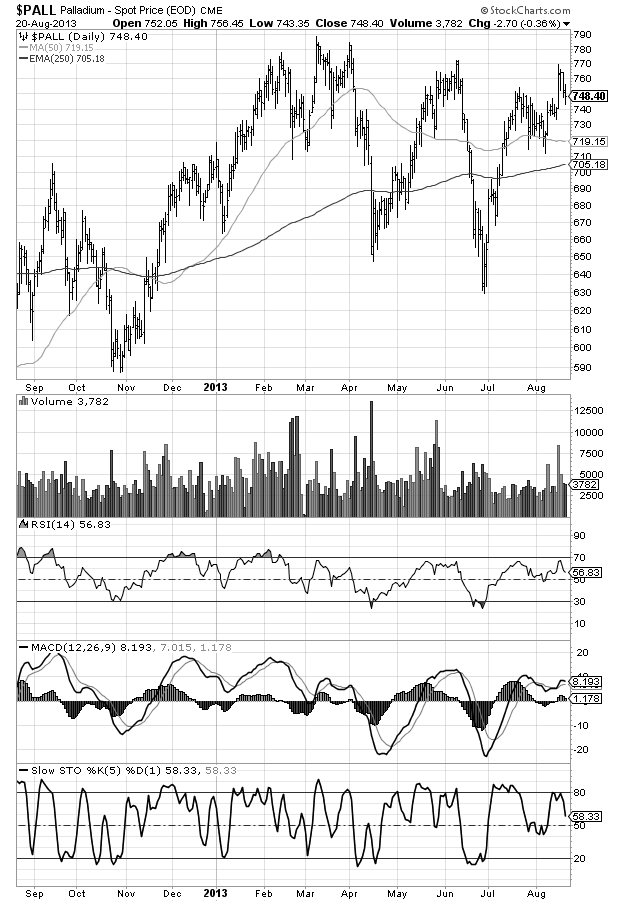

One Year Palladium Chart

With technical indicators

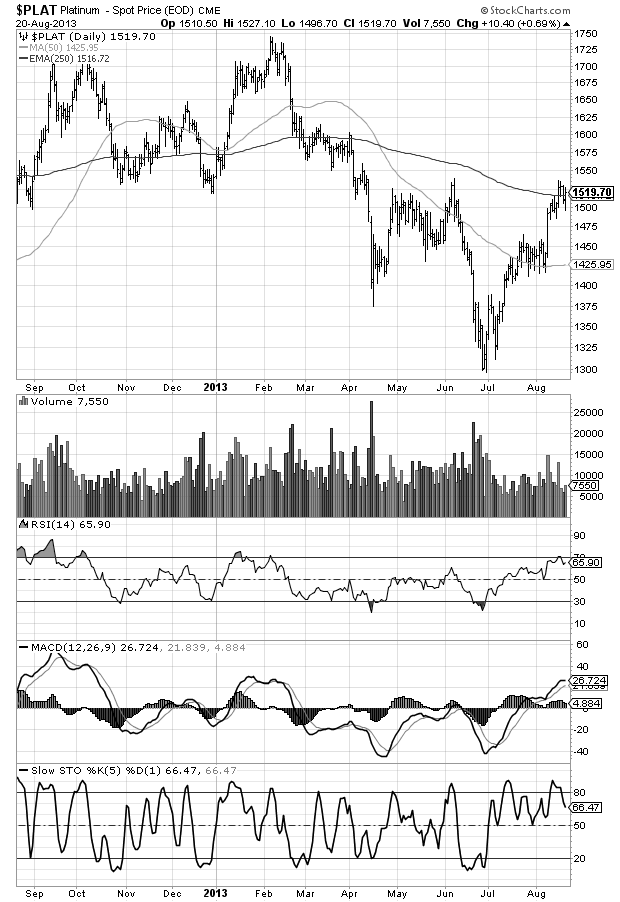

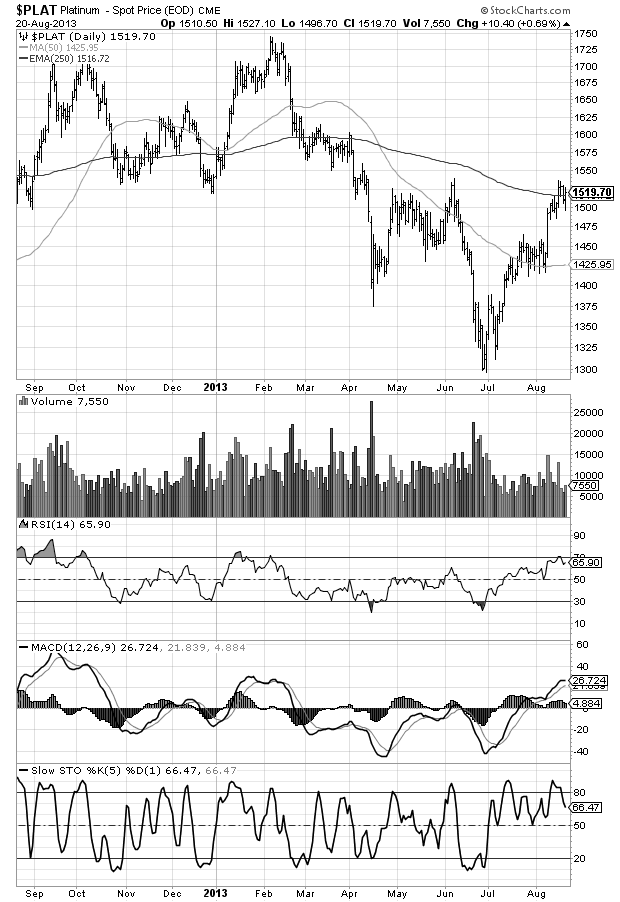

One Year Platinum Chart

With technical indicators

[/private]

Want to speak with Tom Cloud? Call him direct at (800) 247-2812