For the last several years, I have been explaining the importance of diversification when it comes to your finances. When I talk about diversification, I believe that it should apply to at least three separate areas of your financial life.

– Savings diversification (Diversifying your liquidity)

– Investment diversification (Diversifying your investment dollars across a wide variety of asset classes)

– Income diversification (Creating multiple streams of income into your financial life)

Over the next several days, I am going to begin spending some time explaining why and how all three of these areas should be diversified, along with some ideas on how we do it here at FollowtheMoney.com.

Today, I want to talk briefly about the importance of diversifying your liquid savings. Those of you who are familiar with our Five Levels of Financial Freedom know that in Level Three we teach the need to have six months of liquid savings at all times. (That is, six months of your gross income. If you earn $2,000 per month, you should have $12,000 in extreme liquidity at all times.) This may be difficult for some, or it may be a matter of rearranging finances for others; still, this is an important step in the right direction.

However, having six months of liquid savings is not enough. Inflation is a constant threat to your financial plan in any modern fiat monetary system. Since the U.S. government can order the Federal Reserve to print money at any time, you better believe that inflation will continue to pose a hazard to your finances. So if you want to dampen the ravaging effects of inflation that cause a loss of purchasing power on your money, diversifying your savings should be a priority. I call this strategy the Diversified Six-Month Liquid Savings strategy, in short, DSL Savings™.

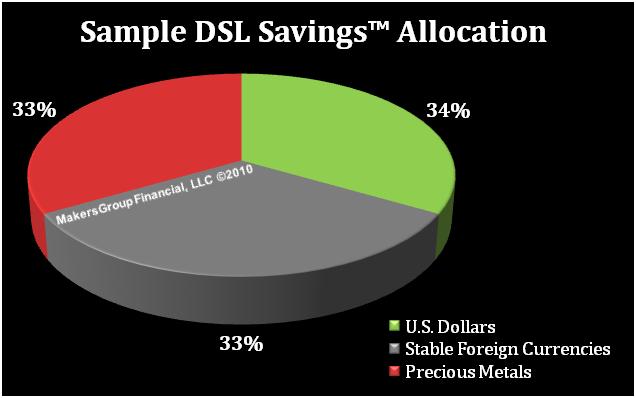

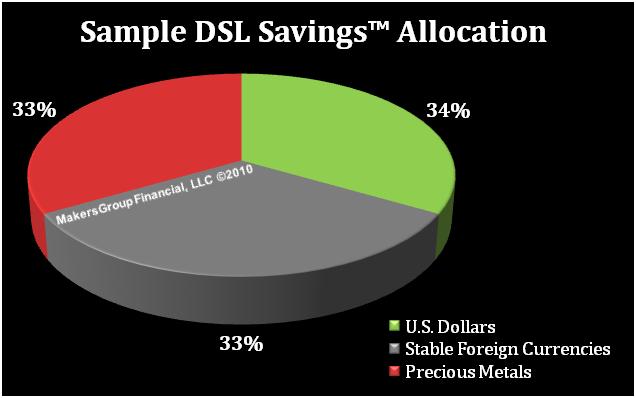

The following describes a sample DSL™ strategy:

Let’s assume that you earn $30,000 per year. In order to create your DSL savings, you would need $15,000.

If you have read my book, Bankruptcy of our Nation: 12 Key Strategies for Protecting Your Finances in these Uncertain Times, you know that I have created a simple model to guide you on how this can be done simply.

• One-third ($5,000) in U.S. dollars (i.e. savings account or money market)

• One-third ($5,000) in a stable foreign currency or a stable basket of currencies

• One-third ($5,000) in precious metals (i.e. gold and silver)

While this is only one diversification strategy for your DSL savings reserve, I have personally found it to be particularly effective in protecting purchasing power. In fact, last year I commissioned a study to back-test the performance of this strategy. Tomorrow, I will discuss that study and the stunning historical performance of this particular savings diversification strategy. (Read Part 2 of this series here.)

Here at FollowtheMoney.com, we are working hard to create solutions for you during these difficult times of economic crisis. We invite your feedback and comments on how we may serve you better.

Until tomorrow,

Jerry Robinson – FollowtheMoney.com