Mastering the Cup and Handle Chart Pattern: A Trader’s Secret Weapon

Hey there, fellow traders! I’ve got some exciting insights to share with you today. We’re going to dive into a powerful chart pattern that can be a game-changer in your trading toolkit – the Cup and Handle Pattern. Trust me; this pattern has the potential to take your trading skills to the next level!

What is the Cup and Handle Pattern?

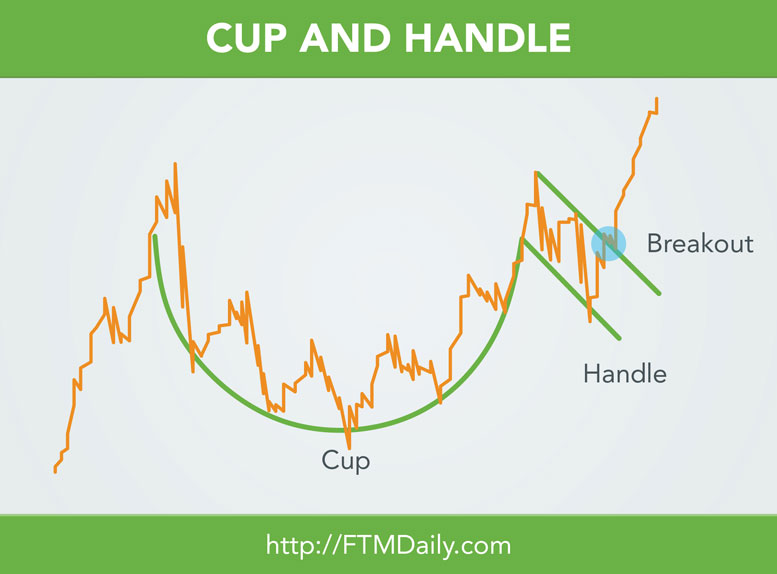

Imagine you’re looking at a price chart, and you notice a U-shaped curve followed by a smaller, downward-sloping price movement. Now connect the high points of the U-shaped curve to form the “Cup,” and draw a smaller, parallel line to the right, forming the “Handle.” Bingo! You’ve just spotted the Cup and Handle Pattern.

What Does it Mean?

The Cup and Handle Pattern is a bullish continuation pattern. In simple terms, it indicates that a brief pause in an uptrend is happening, and once the pattern completes, the uptrend is likely to continue. Think of it as a little resting pit-stop before the price accelerates further.

Why is it Important?

As traders, we love to jump into a trend when the odds are in our favor. The Cup and Handle Pattern can be a powerful ally in spotting these opportunities. By recognizing this pattern, you gain the ability to position yourself strategically, getting in at a prime moment before the next bullish leg begins.

How to Use it in Trading?

Spot the Cup: First, identify the “Cup” part of the pattern. Look for a U-shaped curve formed by the price movement. The bottom of the U should be a rounded, gradual curve, not a sharp V.

Draw the Handle: Once you’ve spotted the Cup, draw the “Handle” part, which is the smaller, downward-sloping price movement on the right side of the U. The handle should be relatively shallow compared to the Cup.

Breakout Confirmation: The pattern is not complete until the price breaks out of the Handle’s upper boundary. This breakout is a strong signal of a potential uptrend continuation. Keep an eye out for high volume during the breakout to confirm the pattern’s strength.

Measure the Target: Estimate the potential price target of the uptrend by measuring the distance from the bottom of the Cup to the pattern’s breakout point. Then add this measurement to the breakout point.

Cup with a Handle Chart Pattern and Cup with Handle Pattern

You might have heard traders referring to the Cup and Handle Pattern as the “Cup with a Handle Chart Pattern” or simply the “Cup with Handle Pattern.” Guess what? They are all talking about the same fantastic pattern! Different names, same powerful tool!

In conclusion, the Cup and Handle Pattern can be a trader’s secret weapon in identifying bullish continuation opportunities. Just remember to combine it with other analysis tools and practice using it on historical charts before implementing it in real-time trading. So, keep your eyes peeled for that cup-shaped dip and handle on your charts, and may it lead you to more profitable trades. Happy trading, folks!

Until tomorrow,

Jerry Robinson

“Daily Economic/Investment Trends for the Savvy Investor”

“Daily Economic/Investment Trends for the Savvy Investor”