Understanding the Bearish Descending Triangle Pattern

Hey there, new traders! Today, we’re going to unravel the secrets of the Descending Triangle Pattern, a powerful tool that can help you navigate the markets with confidence. This bearish chart formation might seem intimidating at first, but fear not! I’m here to break it down into simple terms and show you how to make it work for you.

What is the Descending Triangle Pattern?

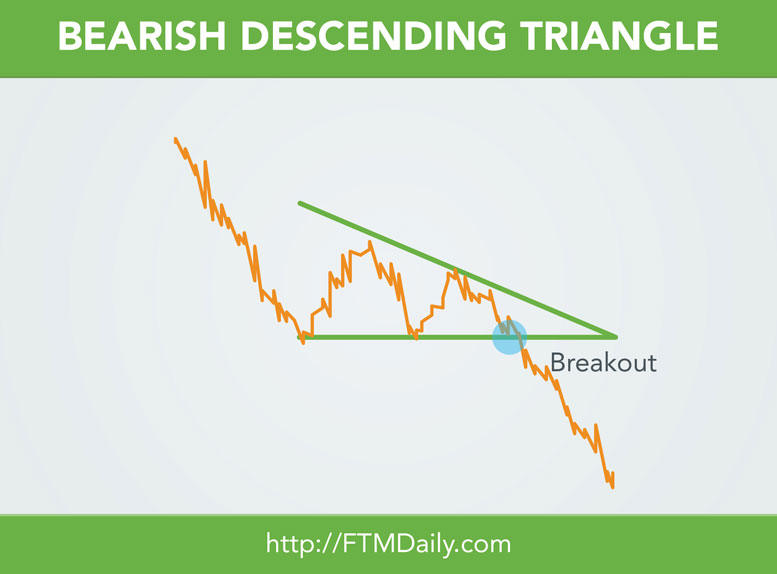

Picture this: you’re looking at a price chart, and you notice a series of lower highs forming a descending trendline and a horizontal support line. These lines come together, creating a triangle shape that points downward. Congratulations, you’ve just spotted the Descending Triangle Pattern!

What Does it Mean?

The Descending Triangle Pattern is a bearish continuation pattern. In plain language, it indicates that a downtrend is likely to resume after a brief consolidation period. It’s like the market is giving you a heads up that the bears might be taking control again.

Why is it Important?

As traders, we’re always on the lookout for potential trend continuation opportunities. The Descending Triangle Pattern can be your trusty ally in this quest. Recognizing this pattern can give you a strategic advantage, allowing you to enter bearish positions with more confidence.

How to Use it in Trading?

1. Identify the Trendlines: The first step is to spot the descending trendline, connecting the lower highs, and the horizontal support line. These two lines will form the boundaries of the triangle.

2. Watch for Breakout/Breakdown: Keep an eye on the price movement within the triangle. Eventually, the price will break either above the descending trendline (bullish breakout) or below the horizontal support line (bearish breakdown).

3. Confirmation is Key: A breakout/breakdown is not confirmed until the price closes decisively outside the triangle. Look for volume to support the price movement; higher volume on the bearish breakdown adds validity to the pattern.

4. Measure the Target: Estimate the potential price target of the downtrend by measuring the height of the triangle’s tallest part (from the horizontal support line to the descending trendline) and projecting it downward from the breakdown point.

Descending Triangle Chart Pattern

You might come across traders referring to the Descending Triangle Pattern as the “Descending Triangle Chart Pattern.” No worries, they’re talking about the same bearish pattern. Different names, same potential!

In conclusion, knowing how to spot and interpret a Descending Triangle Pattern is a valuable tool to have in your trading arsenal, especially when you want to capitalize on bearish opportunities. Remember to combine it with other technical indicators and analysis techniques to enhance your trading skills. So, keep an eye out for those descending triangles on your charts, and may they guide you to profitable trading ventures. Happy trading, folks!

Until next time,

Jerry Robinson

“Daily Economic/Investment Trends for the Savvy Investor”

“Daily Economic/Investment Trends for the Savvy Investor”