One of the hard and fast rules that I have developed after 15+ years of trading in the financial markets is to

never trade in the first 30 minutes of the market’s open. From my experience, I have found that the first 30 minutes of the market’s open is often a time of excessive volatility as overnight orders are being filled and amateur traders are bidding up prices. In fact, our subscribers who receive our

daily trading idea by email and/or text know that we avoid the first 30 minutes of trading at all times.

Therefore, I was intrigued by an article in yesterday’s Wall Street Journal entitled: Why Morning Is the Worst Time to Trade Stocks. The article did a great job of explaining why trading right at the market’s open can put traders at a disadvantage.

According to the article:

“Buying and selling by individual investors is especially heavy in the minutes immediately after the market opens in the U.S. at 9:30 a.m. Eastern time,

when the chances of getting the best price for a stock are lower and swings tend to be bigger, traders and other market observers said.

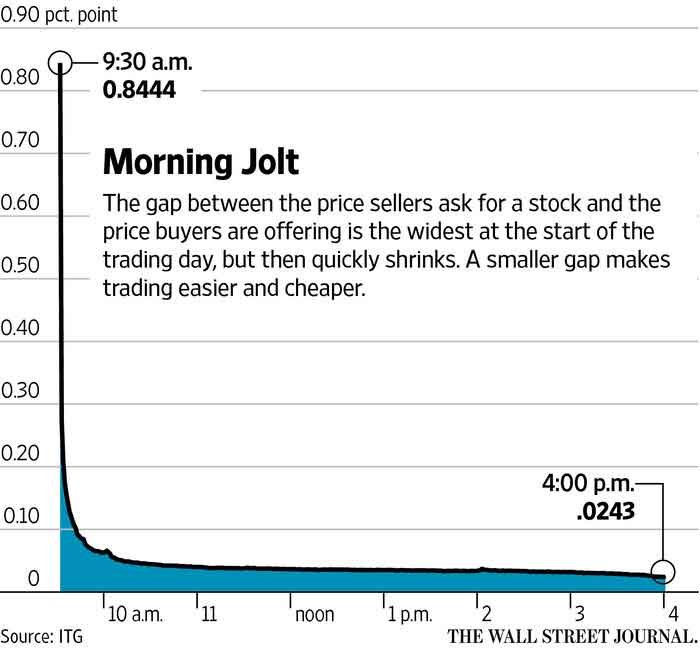

But within minutes, the gap between the price sellers want for a stock, known as the “ask” price, and what buyers are offering, the “bid,” shrinks sharply and continues to narrow up until the end of the trading session. This quirk in the market has been amplified in recent weeks amid the big market swings.”WSJ

This “gap” referred to in the article is known as the bid/ask spread. Put simply, it is the difference between the price at which buyers are willing to buy and sellers are willing to sell. Larger bid/ask spreads can hurt your returns as they often cause your trades to execute at a price that is different from the price that you had expected. This is a phenomenon known as slippage.

According to an analysis by the WSJ:

“In the first half of the year, the difference between the bid and ask prices of shares in the S&P 500 was 0.84 percentage point in the first minute of trading, according to data from ITG, a brokerage. That gap shrinks to 0.08 percentage point after 15 minutes and to less than 0.03 percentage point in the final minutes of the trading day.”

WSJ To avoid excessive slippage costs, it is best to wait for the volatilty at the market’s open to smooth out before you begin trading. That’s why I always sit out the first 30 minutes of the trading day. I wait for the market to smooth out and then begin looking for opportunities.

Until tomorrow,

Jerry Robinson