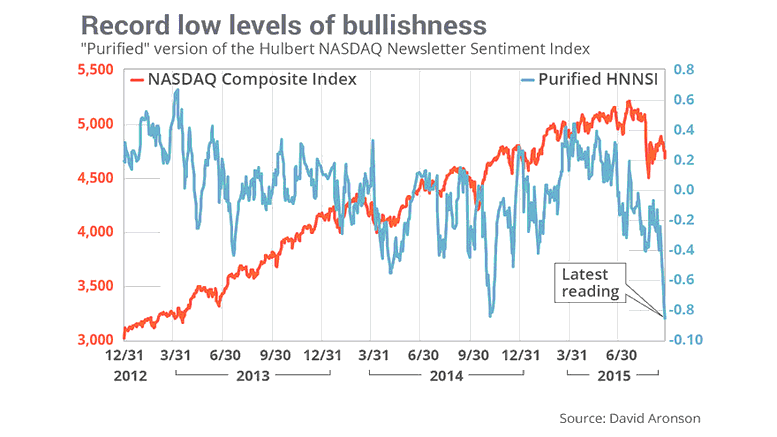

According to at least one popular market sentiment indicator, U.S. stock investors are more bearish than at any time in the last 15 years. In fact, you would have to go back to the heights of the dot-com bubble of 2000 to find more bearishness on U.S. stocks.

As seen in today’s chart, this is based upon the stock recommendations of several investment newsletters as measured by the Hulbert Nasdaq Newsletter Sentiment Index, or HNNSI.

Other market sentiment indicators, like the Citigroup Panic/Euphoria Model, the put-call ratio, and many others also confirm that U.S. stock investors are becoming increasingly bearish and expect more downside risk ahead.

It’s not difficult to understand why investors are losing heart. The available data suggests that the global economy, led by years of China’s explosive growth, is beginning to grind to a halt. Meanwhile, the Fed is sending investors mixed messages. On one hand, they exclaim the health of the U.S. economy. And on the other hand, they are hesitant to raise interest rates by a measly 25 basis points.

What gives?

If, after six years of massive monetary stimulus, the Fed is unable to lift rates by a mere fraction of a percent, something must be very wrong.

Indeed, that is exactly what investors are beginning to grasp.

Learn more about Jerry Robinson’s Daily Trade Setups

Here at FTMDaily, we don’t invest by guessing the direction of the market. We don’t try to read the tea leaves or guess what the Fed will do tomorrow.

Instead, we follow a simple trend following system that keeps us in the market when it is a confirmed uptrend. And then we get out when the broad stock indices form a confirmed downtrend. (After 15+ years of successful trading, I can testify that following the trend is the only way to consistently make money in today’s wild financial markets.)

For the last several weeks, our system has told us to get out of stocks. Instead, we are now using strategies to make money as stock prices fall.

Based upon our system, it appears there is even more downside ahead, and I fully expect that we will soon re-test — and move below — the lows that stocks reached last month.

Until next time,

Jerry Robinson

P.S. Here at FTMDaily, we specialize in providing timely investing education and trading insights to help you profit from any kind of market — up or down. If you are not currently a premium subscriber, I invite you to try out any of our premium services completely risk-free. Try any of our services and if you are not absolutely satisified, we’ll provide you with a full refund, no questions asked. Isn’t it time you invested in yourself? View our

plans are pricing here.