Should I Buy Bonds in Retirement?

Interest rates are inevitably heading higher in the future. When interest rates do finally begin trending higher, how will that impact fixed income investors, particularly those who invest in long-term bonds. What is the risk to the bond portion of your investment portfolio when interest rates go up?

Interest rates are inevitably heading higher in the future. When interest rates do finally begin trending higher, how will that impact fixed income investors, particularly those who invest in long-term bonds. What is the risk to the bond portion of your investment portfolio when interest rates go up?

Our current, ultra-low interest rate environment causes two major problems for fixed income investors:

1) Lack of meaningful yields today

2) Potential for depreciating bond values tomorrow

It’s a simple economic equation: When interest rates rise, bond prices fall.

However, this established inverse relationship that exists between interest rates and bond prices does not operate in a symmetrical fashion. What many investors do not know is that an 1% increase in interest rates will not necessarily translate into a corresponding 1% decline in bond prices. This inverse relationship is prone to arbitrage and exploitation by the well-heeled money players on Wall Street, and opportunistic foreign investors.

Case in point: 2009, in the bloody wake of worst financial crisis since the Great Depression.

That year, the interest rate on 5-Year Treasury Bonds rose by 1.19%. Meanwhile, the bond values on those same 5-Year Treasury Bonds tumbled a whopping 5.6%!

But the carnage was even worse for bonds with longer maturities.

In 2009, interest rates on 10-Year Treasury bonds rose 1.3% as bond values plummeted in value by 8.2%!

Interest rates increased by 1.65% on the 30-Year Treasury bond, while the bond’s value fell a shocking 25.99%!

Many financial advisors push pre-built “recommended” asset allocation models that include putting some of your money in stocks and the rest in bonds. They recommend bonds because they consider them to be a “safer” alternative to the stock market.

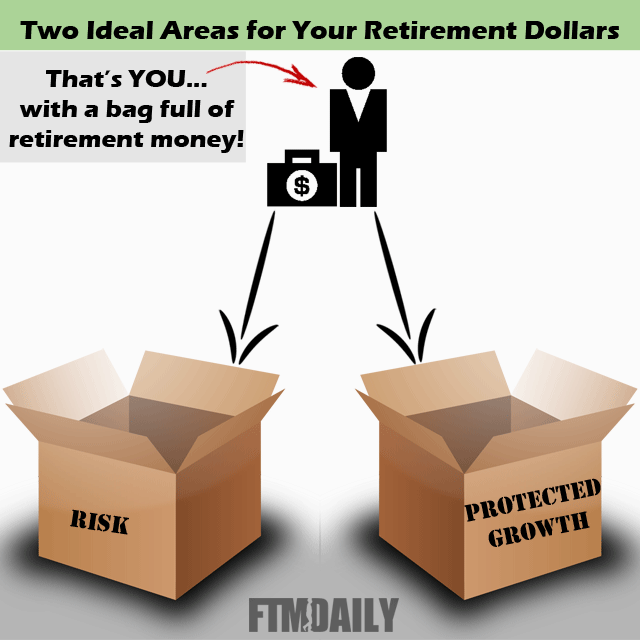

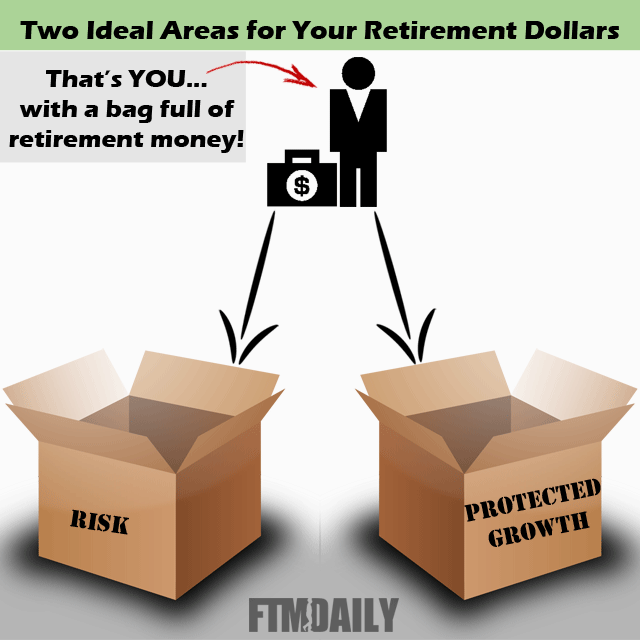

Action Point: Properly Diversify Your Retirement Dollars

We agree for the need of a “safer” alternative to U.S. stocks, but disagree that bonds are the best alternative for most situations.

Like those who recommend stocks and bonds, we also agree that there are two areas where most individuals should consider investing their retirement assets.

To help you fully understand these two areas, imagine two boxes in front of you.

The first box is called the Risk Box. The money that is in this box includes any investment that rises in value as the markets go up, and loses value when the markets go down. This could include stocks, mutual funds, real estate, and even some bonds.

The second box is called the Protected Growth Box. In this box, you earn when the market rises, but (and here’s the big difference) when the market goes down, you do not earn anything. When the market drops, the money in your Protected Growth Box experiences no gains and no losses.

Many financial advisors will tell you invest to in bonds for the Protected Growth box. But as we have seen, bonds can — and do — lose value. Therefore, bonds are not always the most appropriate investment for the Protected Growth Box.

Of course, your specific financial plan will be determined by two important things:

1) Your overall tolerance for risk

2) And what you are trying to accomplish with your investments

The most common question we receive regarding this two box retirement strategy is: How much should I place into each box? Should I split my retirement money in half, putting 50% in the Risk Box and 50% in the Protected Growth Box?

When attempting to answer these questions, we recommend that you consider the Rule of Age 100.

According to the Rule of Age 100: Whatever your age is, that is the percent of your retirement dollars that should be in the Protected Growth box.

According to this rule, if you are age 60, then 60% of your total retirement assets should be protected and preserved in the Protected Growth Box. This leaves the remaining 40% to place into the Risk Box. Obviously, this is just one rule to consider. The exact ratio that you select should be based upon your own retirement goals and risk tolerance.

DISCLAIMER

Investing involves risk. Always do your own due diligence and consult a trusted financial professional before making any investing or financial decisions.

Interest rates are inevitably heading higher in the future. When interest rates do finally begin trending higher, how will that impact fixed income investors, particularly those who invest in long-term bonds. What is the risk to the bond portion of your investment portfolio when interest rates go up?

Interest rates are inevitably heading higher in the future. When interest rates do finally begin trending higher, how will that impact fixed income investors, particularly those who invest in long-term bonds. What is the risk to the bond portion of your investment portfolio when interest rates go up?