(Click the image to enlarge)

(Click the image to enlarge)

With the recent passing of Apple’s Steve Jobs at the young age of 56, we are all reminded that life is fragile and can end much earlier than perhaps we planned. One of the most selfless things that we can do is to confront our mortality now, while we are still healthy, and make the hard decisions about how we may want our estate handled when we inevitably pass.

The topic of estate planning can be an intimidating topic for many people. However, those who avoid confronting it will often, unintentionally, punish their heirs and enrich local, state, and federal governments.

Naturally, most people desire to leave the bulk of their estate to their loved ones and favorite charities. But given our current tax laws and overall hostile economic environment to wealth preservation, this is much easier said than done. Doing so requires very intentional and specific planning that almost always necessitates a trained estate planning professional. Often, the costs associated with this type of planning may seem daunting, but they are often more reasonable than you may think.

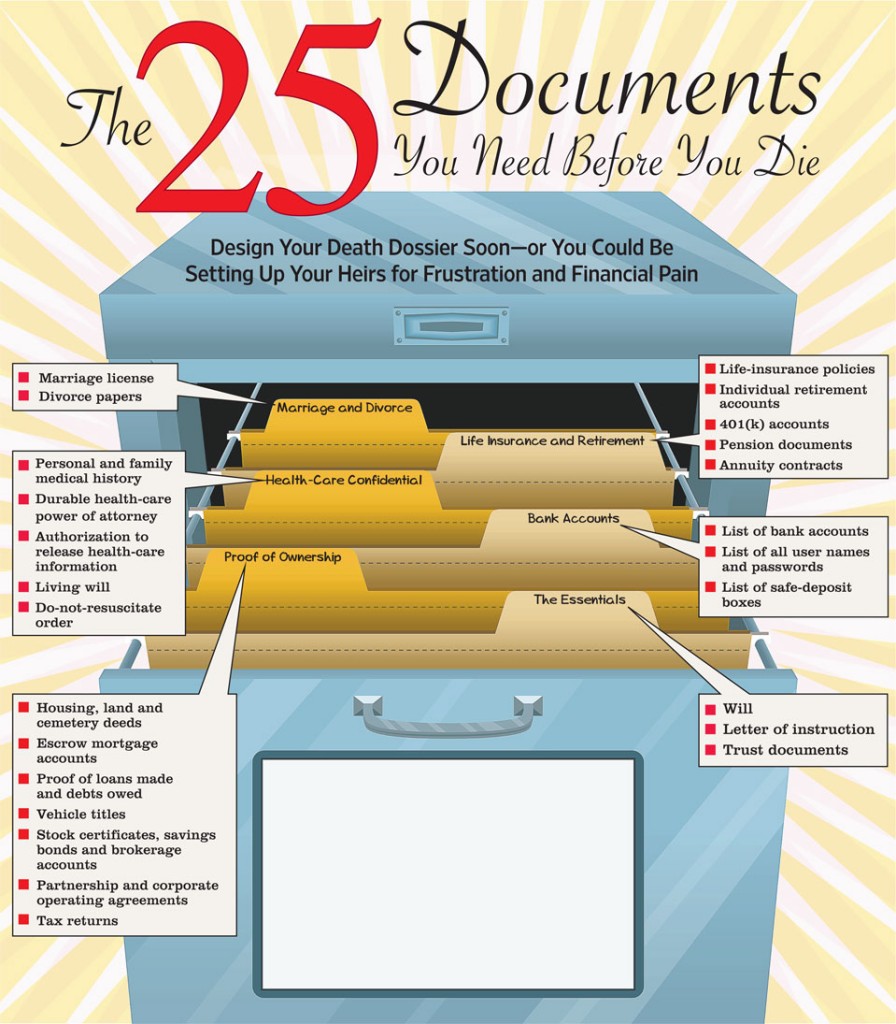

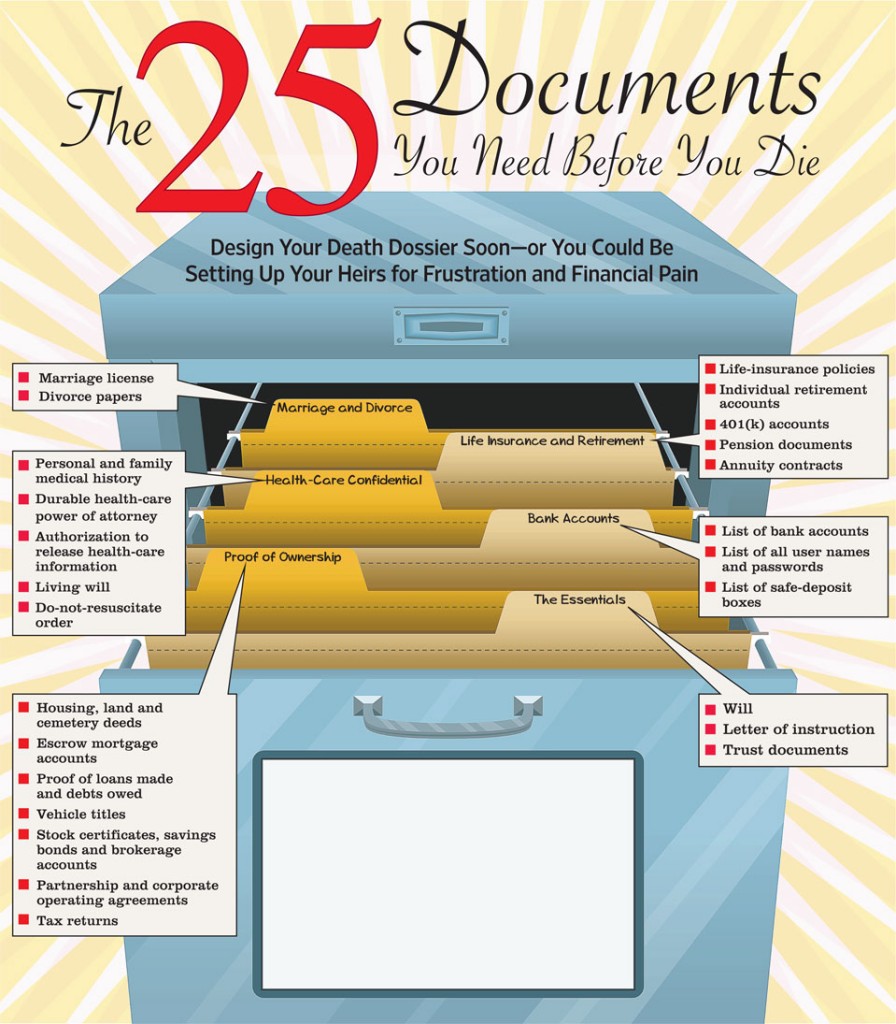

A few months ago, I read an interesting story in the Wall Street Journal which laid out the 25 documents that every individual needs to have in order before they die. Below is an interesting infographic from the original article.

_______________________________________________________