CHINA’S $24 TRILLION DEBT BUBBLE

Leading Chinese Securities Firm Warns of Growing Default Risk as China’s Debt Soars

- China’s Second Largest Securities Firm Issues Latest Warning. Haitong Securities, China’s second largest brokerage, is warning investors that China’s soaring debt levels threaten to trigger a new financial crisis. According to the latest estimates, liabilities held by China’s non-financial firms may exceed 150% of GDP in 2014. “We are concerned that the debt snowball may get bigger and bigger and turn into a crisis,” said Li Ning, a bond analyst at Haitong Securities. “Default probabilities from next year may rise because more and more Chinese companies depend on new borrowings to repay old debt.”

- China’s $24 Trillion Debt Bubble. By now, many investors know that since 2008, credit in China has exploded by $15.4 trillion, from $9 trillion to an astounding figure of $24 trillion — as much as the U.S. and Japanese banking systems combined. (In comparison, total U.S. bank assets grew by just $2.2 trillion during this same time period!) China’s monetary authorities are now attempting to rein in the world’s biggest credit bubble, which remains extremely vulnerable to higher borrowing costs. The astounding growth in Chinese credit in recent years is unprecedented, and easily qualifies as the largest bubble in world history. Over the past five years, credit growth in China has grown by nearly 30% annually, far outpacing China’s 8% +/- annual GDP figures. To put this in perspective, China’s rate of credit growth is far greater than that which preceded the bursting of Japan’s property bubble in 1990, South Korea’s 1998 crisis, and even the more recent explosion of subprime credit in the U.S. In classic style, China has attempted to manage perceptions by banning journalists from reporting on this $24 trillion debt bubble, which has become a ticking time bomb as local interest rates begin to skyrocket. Meanwhile, hot money continues to flow out of China. Record amounts of wealthy Chinese investors are moving money out of the country into foreign asset classes (U.S. and European real estate, precious metals, etc.) What’s next? Perhaps a meaningful increase in oversight, or even a TARP-style bailout. But it is virtually impossible that China, and the world economy, will escape this monetary madness unscathed. It’s time to prepare.

Inside this Issue

“Profiting From the Coming Paper Money Collapse”

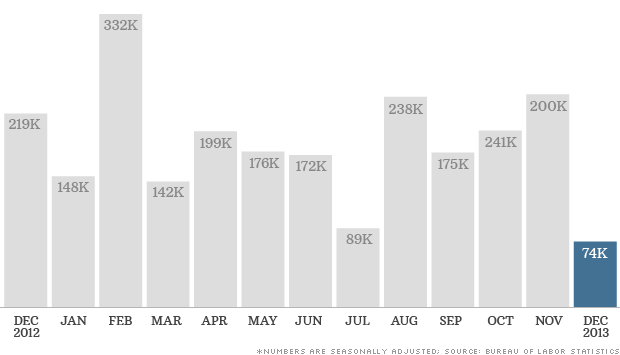

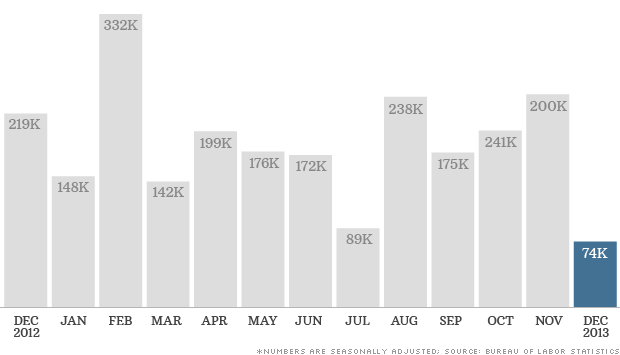

DECEMBER JOBS REPORT SHOCKS ECONOMISTS; 197,000 Est. VS 74,000 Actual

As “official” U.S. unemployment rate drops to 6.7%, the labor force participation rate dips to 62.8% — it’s lowest level since 1978.

Mortgage bankers forecast that loan originations, hurt by higher rates, will fall to a 14-year low in 2014.

Shipments of desktop and laptop computers have never fallen so dramatically as more consumers, even in emerging nations, prefer tablets and smartphones.

China’s annual trade in goods passed the $4trn (£2.4trn) mark for the first time in 2013, official data has revealed, confirming its position as the world’s biggest trading nation.

View the Investor Wire Archive >>

U.S. Financial Markets

Real-time Gold and Silver Prices

|

Precious Metals Market Update with Tom Cloud

Read/Print the Audio Transcript or Download the mp3

View Our Precious Metals Investing Resources Here >>

“World News Headlines That We Are Tracking”

That’s over 60 percent of the nations on the planet.

First Syria, now North Korea…

Amazing images of America’s recent Arctic blast.

The Defense Ministry wants to conceal the full list to avoid a public debate over the morality of selling arms to dictatorial regimes.

On May 15th, 1948, the modern nation of Israel officially became a sovereign territory belonging to the Jewish people.

The research comes just after it was revealed that people who have a spiritual side have a ‘thicker’ section of brain tissue than those who do not, possibly helping them stave off depression.

Broadcast Every Saturday Morning – Hosted by Jerry Robinson

Topic: On this week’s show, economist and investor Jerry Robinson explains how stock traders can profit from current financial trends.

Read Show Notes >>

Download Now >>

(Right click link above and ‘save as’ to your device)

Other Listening Options

“Archiving the Rise of Big Brother, the Erosion of Personal Liberty, and the Fall of the Republic”

New FTMDaily.com Social Poll

(No log-in required; Vote anonymously)

[socialpoll id=”2183060″]

Proponent: “Replacing marijuana prohibition with a system of taxation and sensible regulation will bolster Alaska’s economy by creating jobs and generating revenue for the state.”

New EU civil liberties committee report condemns mass surveillance in the “strongest possible terms.”

Marijuana may be legal in Colorado in 2014, but there are still hundreds of marijuana convicts sitting in Colorado state jails.

View the Liberty Wire Archive >>

“Daily Investment Trends for the Savvy Investor”

You are attempting to view premium content for subscribers only. If you are a subscriber, log in here. If you are not currently subscribed, you can learn more here.

View the Daily Chart Archive >>

“A Daily Stock Trading Idea for Short-Term Traders”

— Subscribers Only —

You are attempting to view premium content for subscribers only. If you are a subscriber, log in here. If you are not currently subscribed, you can learn more here.

Enter the Trading Room to View all Trading Activity >>

Not a subscriber? Learn more here >>

“A Daily Dose of Financial Wisdom from God’s Word”

“It is well with the man who deals generously and lends, who conducts his affairs with justice.”

Psalm 112:5

What will I get?