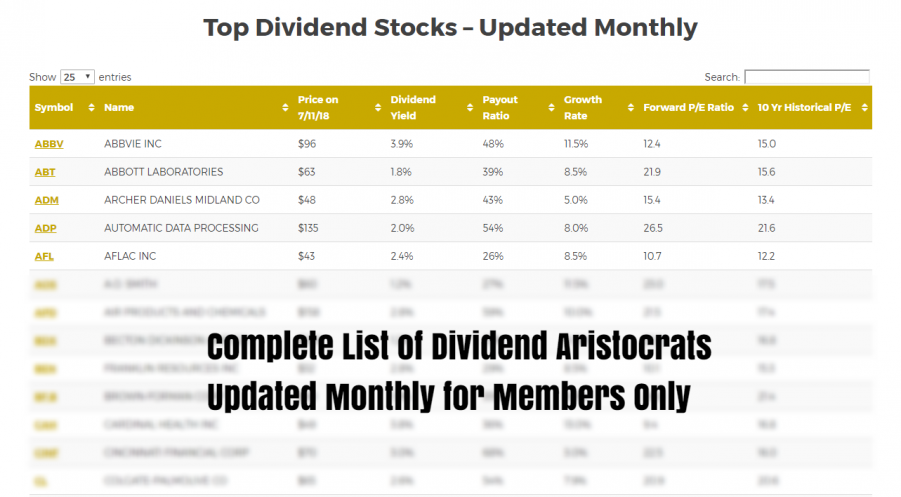

Login to view this month’s Dividend Aristocrat list

Not a member? Start your 7-Day Free Trial

NEW FEATURE! The Dividend Aristocrats are now ranked by our proprietary SmartScore Ranking System.

For new investors and traders, Dividend Aristocrats may be an unfamiliar term. However, this is a very important concept to understand as it can help investors choose stocks that are stable and offer consistent dividends.

What are Dividend Aristocrats?

Dividend Aristocrats are stocks that have consistently increased their dividends for at least 25 consecutive years. These companies are typically considered to be industry leaders with strong financial performance and stable earnings growth. Dividend Aristocrats are known for their ability to weather market volatility and provide a reliable source of income for investors.

Dividend Aristocrats are stocks that have consistently increased their dividends for at least 25 consecutive years. These companies are typically considered to be industry leaders with strong financial performance and stable earnings growth. Dividend Aristocrats are known for their ability to weather market volatility and provide a reliable source of income for investors.

Why are Dividend Aristocrats a good investment option?

Dividend Aristocrats are considered to be a good investment option for several reasons. First, these companies have a proven track record of stability and growth. They have been able to consistently increase their dividends for at least 25 consecutive years, which is a sign of financial strength and solid management.

So too, Dividend Aristocrats can offer a higher yield than other stocks. Because these companies have a long history of consistent dividends, they often have a higher yield than other stocks in the same industry. This can provide investors with a higher income stream and help to diversify their portfolio.

How can investors and traders invest in Dividend Aristocrats?

Investors and traders can invest in Dividend Aristocrats by purchasing individual stocks or through an exchange-traded fund (ETF) that tracks the S&P 500 Dividend Aristocrats index. This index includes all 68 Dividend Aristocrats in the S&P 500 index and provides investors with exposure to a diversified portfolio of these stocks.

When investing in Dividend Aristocrats, it is important to consider factors such as the company’s financial performance, dividend yield, and overall market conditions. As with any investment, there are risks involved, including the potential for stock price fluctuations and changes in the company’s financial performance.

In conclusion, Dividend Aristocrats are stocks that have consistently increased their dividends for at least 25 consecutive years. These companies are known for their stability, growth, and ability to weather market volatility. For investors and traders, Dividend Aristocrats can be a valuable investment option, offering a reliable source of income and the potential for higher yields. As with any investment, it is important to carefully consider the risks and make informed decisions.

Start your 7-day free trial to unlock access to this month’s Dividend Aristocrat list and many more regularly updated stock lists specifically created for swing traders, position traders, and long-term investors.

When it comes to dividend-paying stocks, the size of the dividend is less important than its growth rate and its sustainability. Companies that consistently reward shareholders with annual increases in the size of their dividends are categorized into three distinct groups:

Dividend Kings: A small list of U.S. stocks that have been paying – and more importantly, increasing – their annual dividend for more than 50 years!

Dividend Aristocrats: A highly select group of U.S. stocks that has been paying and increasing their annual dividends every year for at least the past 25 years.

Dividend Achievers: A list of U.S. stocks that have been paying and increasing their annual dividend for at least the last 10 years.

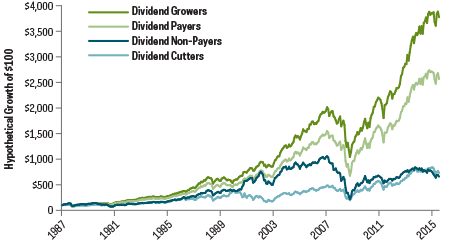

U.S. Dividend Growers Outperformance

Russell 3000 Index, January 1987-December 31, 2015

Source: Ned Davis Research analysis of companies underlying the Russell 3000 Index, a measure of the broad U.S. equities market; the MSCI EAFE Index, a leading developed market index; and the MSCI Emerging Markets Index, a leading emerging markets index. Data for Russell 3000 companies is from February 2, 1987 through December 31, 2015. Data for MSCI EAFE companies is from June 30, 1996 through December 31, 2015. Data for MSCI Emerging Markets Index companies is from June 30, 1996 through December 31, 2015. Past performance does not guarantee future results.