This four part article series is available as a single full color 51 page PDF sent right to your inbox.

Download it here absolutely free >> .

Preparing for the Collapse of the Petrodollar System, Part 2

The Rise of the Petrodollar System: “Dollars for Oil”

(Miss Part One? Start here.)

Introduction to Part Two

In part one of this four part article series, I provided a background to our modern petrodollar system by explaining the “dollars for gold” arrangement that was put in place by global leaders through the Bretton Woods conference in the final days of World War II.

The article provided a brief evolution of the Bretton Woods agreement from its inception in 1944 to its ultimate demise in 1971. As detailed, in the late 1960’s, this “dollars for gold” system had become unsustainable as Washington insisted upon the adoption of a “welfare state” that relied upon massive entitlements and a “warfare state” that required perpetual wars.

In the second installment of this article series, I will further explain the circumstances surrounding the demise of this failed “dollars for gold” arrangement, with a particular emphasis on how its demise dealt a major blow to global dollar demand.

I will detail how the Washington elites sought to replace the lost global dollar demand that had been artificially created through the Bretton Woods system. Their solution would come in the form of something known as the Petrodollar system. The three primary benefits that the Petrodollar system provides to America will be explained.

And finally, the article will conclude with a brief examination of how the Petrodollar system has influenced U.S.-Middle East relations with a specific focus on Israel.

The Same Game with a New Name: “Dollars for Oil” Replaces “Dollars for Gold”

In the early 1970s, the final vestiges of the international gold-backed dollar standard, known as the Bretton Woods arrangement, had collapsed. Many foreign nations who had previously agreed to a gold-backed dollar as the global reserve currency were now having serious mixed feelings about the arrangement. Nations like Britain, France, and Germany determined that a cash-strapped and debt-crazed United States was in no financial shape to be leading the global economy. These were just a few of the many nations which began demanding gold in exchange for their dollars.

Despite pressure from foreign nations to protect the dollar’s value by reining in excessive government spending, Washington displayed little fiscal constraint and continued to live far beyond its means. It had become obvious to all that America lacked the basic fiscal discipline which could prevent the destruction of its own currency.

Like previous governments before it, America had figured out how to “game” the global reserve currency system for its own benefit, leaving foreign nations in an economically vulnerable position. After America and its citizens had tasted the sweet fruit of excessive living at the expense of other nations, the party was over.

It is unfair, however, to say that the Washington elites were blind to the deep economic issues confronting it in the late 1960’s and early 1970’s. Washington knew that the “dollars for gold” had become completely unsustainable. But instead of seeking solutions to the global economic imbalances that had been created by America’s excessive deficits, Washington’s primary concern was how to gain an even greater stranglehold on the global economy.

In order to ensure their economic hegemony, and thereby preserve an increasing demand for the dollar, the Washington elites needed a plan. In order for this plan to succeed, it would require that the artificial dollar demand that had been lost in the wake of the Bretton Woods collapse be replaced through some other mechanism.

According to John Perkins, the author of Confessions of an Economic Hit Man: The Shocking Story of How America Really Took Over the World, that plan came in the form of the petrodollar system.

(Click here to listen to Jerry Robinson’s interview with John Perkins.)

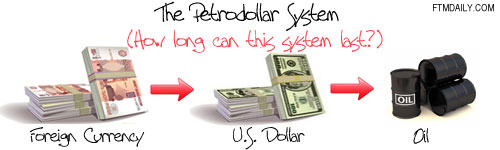

But what exactly is the petrodollar system?

First, let’s define what a petrodollar is.

A petrodollar is a U.S. dollar that is received by an oil producer in exchange for selling oil, and that is then deposited into Western banks.

Despite the seeming simplicity of this arrangement of “dollars for oil,” the petrodollar system is actually highly complex and one with many moving parts. It is this complexity that prevents the petrodollar system from being properly understood by the American public.

Allow me to provide a very basic overview regarding the history and the mechanics of the petrodollar system.

It is my belief that once you understand this “dollars for oil”arrangement, you will gain a more accurate understanding of what motivates America’s economic (and especially foreign) policy.

So, let’s take a closer look…

The Rise of the Petrodollar System

The petrodollar system originated in the early 1970s in the wake of the Bretton Woods collapse.

President Richard M. Nixon and his globalist sidekick, Secretary of State, Henry Kissinger, knew that their destruction of the international gold standard under the Bretton Woods arrangement would cause a decline in theartificial global demand for the U.S. dollar. Maintaining this “artificial dollar demand” was vital if the United States were to continue expanding its “welfare and warfare” spending.

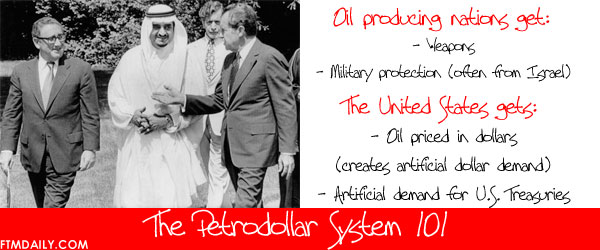

In a series of meetings, the United States — represented by then U.S. Secretary of State Henry Kissinger — and the Saudi royal family made a powerful agreement. (Several authors have worked to compile data on the origins of the petrodollar system, some exhaustively, including Richard Duncan, William R. Clark, David E. Spiro, Charles Goyette and F. William Engdahl).

According to the agreement, the United States would offer military protection for Saudi Arabia’s oil fields. The U.S. also agreed to provide the Saudis with weapons, and perhaps most importantly, guaranteed protection from Israel.

The Saudi royal family knew a good deal when they saw one. They were more than happy to accept American weapons and a U.S. guarantee to restrain attacks from neighboring Israel.

Naturally, the Saudis wondered how much all of this U.S. military muscle was going to cost…

What exactly did the United States want in exchange for their weapons and military protection?

The Americans laid out their terms. They were simple and two-fold.

1) The Saudis must agree to price all of their oil sales in U.S. dollars only. (In other words, the Saudis were to refuse all other currencies except the U.S. dollar as payment for their oil exports.)

2) The Saudis would be open to investing their surplus oil proceeds in U.S. debt securities.

You can almost hear one of the Saudi officials in a meeting saying: “Really? That’s all? You don’t want any of our money or our oil? You just want to tell us how to price our oil and then you will give us weapons, military support, and guaranteed protection from our enemy, Israel? You’ve got a deal!”

However, the U.S. had done its economic homework. If they could get the Saudis to buy into this deal, it would be enough to launch them into the economic stratosphere in the coming decades.

Fast forward to 1974 when the petrodollar system was fully operational in Saudi Arabia.

And just as the United States had cleverly calculated, it did not take long before other oil-producing nations wanted in on the deal.

By 1975, all of the oil-producing nations of OPEC had agreed to price their oil in dollars and to hold their surplus oil proceeds in U.S. government debt securities in exchange for the generous offers by the U.S.

Just dangle weapons, military aid, and guaranteed protection from Israel in front of third world, oil-rich, Middle East nations… and let the bidding begin.

Nixon and Kissinger had successfully bridged the gap between the failed Bretton Woods arrangement and the new Petrodollar system. The global artificial demand for U.S. dollars would not only remain intact, it would soar due to the increasing demand for oil around the world.

And from the perspective of empire, this new “dollars for oil” system was much more preferred over the former “dollars for gold” system as its economic requirements were much less stringent. Without the constraints imposed by a rigid gold standard, the U.S. monetary base could be grown at exponential rates.

It should come as no surprise that the United States maintains a major military presence in much of the Persian Gulf region, including the following countries: Bahrain, Iraq, Kuwait, Oman, Qatar, Saudi Arabia, United Arab Emirates, Egypt, Israel, Jordan, and Yemen.

The truth is easy to find when you follow the money…

The Petrodollar System Encourages Cheap Exports to the United States

While the U.S./Saudi agreement may have smelled of desperation at a time of decreasing global dollar demand, it can now be considered one of the most brilliant geopolitical and economic strategies in recent political memory.

Today, virtually all global oil transactions are settled in U.S. dollars. (There are a few exceptions and they will be highlighted in our next article appropriately titled, The Petrodollar Wars.) When a country does not have a surplus of U.S. dollars, it must create a strategy to obtain them in order to buy oil.

The easiest way to obtain U.S. dollars is through the foreign exchange markets. This is not, however, a viable long-term solution as it is cost-prohibitive. Therefore, many countries have opted instead to develop an export-led strategy with the United States in order to exchange their goods and services for the U.S. dollars that they need to purchase oil in the global markets. (This should help explain much of East Asia’s export-led strategy since the 1980’s.) Japan, for example, is an island nation with very few natural resources. It must import large amounts of commodities, including oil, which requires U.S. dollars. So Japan manufactures a Honda and ships it to the United States and immediately receives payment in U.S. dollars.

Problem solved… and export-led strategy explained.

The Primary Benefits of the Petrodollar System

The petrodollar system has proven tremendously beneficial to the U.S. economy. In addition to creating a marketplace for affordable imported goods from countries who need U.S. dollars, there are more specific benefits.

In essence, America receives a double loan out of every global oil transaction.

First, oil consumers are required to purchase oil in U.S. dollars.

Second, the excess profits of the oil-producing nations are then placed into U.S. government debt securities held in Western banks.

The petrodollar system provides at least three immediate benefits to the United States.

- It increases global demand for U.S. dollars

- It increases global demand for U.S. debt securities

- It gives the United States the ability to buy oil with a currency it can print at will

Let’s briefly examine each one of these benefits.

1. The petrodollar system increases global dollar demand.

Why is consistent global demand for the dollar a benefit? In many ways, currencies are just like any other commodity: the more demand that exists for the currency, the better it is for the producer.

HAMBURGERS, PERMISSION SLIPS, AND THE PETRODOLLAR

To help illustrate this point, let’s imagine that you decided to open a hamburger stand in a small town with a population of 50,000. Of course, not everyone likes

hamburgers, so only a certain percentage of your town’s population will actually ever be a potential customer. And since you are obviously not the only hamburger stand in town, your competitors will all be attempting to reach the same portion of your town’s population as you are.

Now, as an owner of a hamburger stand in a very small town, would you prefer to have demand for hamburgers from your own town only… or would you like to have hamburger demand from other nearby towns and communities too? (My guess is that you would like to have more customers, as that potentially means more money in your pocket.)

Now, let’s take it a step further with another question…

Would you rather have demand for your burgers from your own town and nearby communities only… or would you prefer to have all of the hamburger demand in your entire state?

Once again, the answer should be obvious. Every good business understands that increasing consumer demand is a good thing for their company’s bottom line.

To put it another way, if consumers all over your state are demanding your burgers, you have just been given a permission slip to hire more burger flippers so that you can produce more burgers. (This concept of a demand-based permission slip is important so keep it under your hat for a moment.)

Okay, now allow me to go even one ridiculous step further…

Imagine that Oprah Winfrey is driving through your state and just so happens to stop in at your growing hamburger stand. (I know… This is getting ridiculous… Just bear with me. I really do have a point here.) After Oprah tries your hamburger, she expresses utter amazement at your culinary skills. Oprah is now a raving fan of your burger joint and invites you onto her show to tell the whole world about your hamburgers.

It doesn’t take an economist to figure out what is going to happen to the demand for your burgers… it is going to skyrocket.

Your hamburger demand is now global. Congratulations!

As the demand for your hamburgers increases dramatically, so too the supply must increase. Your newfound global hamburger demand has given you a“permission slip” to buy even more frozen patties and hire new fry cooks.

The important concept here is that a growing demand “permits” the producer to increase his supply.

Now, let’s conclude our hamburger illustration by imagining that an up and coming rival hamburger company becomes a major competitor with your hamburger restaurant chain. As many of your customers begin visiting your new competitor, the demand for your hamburgers begins to wane. As the demand for your burgers drops, you no longer have a “permission slip” to buy as many frozen patties as you did before. As demand for your burgers continues to fall, it makes little sense to hire more workers. Instead, to remain competitive, you must lay off workers and buy fewer frozen patties just to keep your company afloat. Furthermore, you may even need to sell your existing burgers at a discount before they spoil.

If you decided to ignore the warning signs and continue hiring new employees and buying more patties than were actually demanded by your customers, you would soon find your company nearing bankruptcy.

At some point, logic would dictate that you must decrease your supply.

____________________________________________

How it all applies to the U.S. Dollar: Now let’s apply the same economic logic that we used to explain the increasing and decreasing demand for your hamburgers to the global demand for U.S. dollars.

If it is only Americans who “demand” U.S. dollars, then the supply of dollars that Washington and the Federal Reserve can “supply”, or create, is limited to our own country’s demand.

However, if Washington can somehow create a growing global demand for its paper dollars, then it has given itself a “permission slip” to continually increase the supply of dollars.

This is exactly the type of scenario that the petrodollar system created in the early 1970’s. By creating incentives for all oil-exporting nations to denominate their oil sales in U.S. dollars, the Washington elites effectively assured an increasing global demand for their currency. As the world became increasingly dependent on oil, this system paid handsome dividends to the U.S. by creating a consistent global demand for U.S. dollars.

And, of course, the Federal Reserve’s printing presses stood ready to meet this growing dollar demand with freshly printed U.S. dollars. After all, what kind of central bank would the Federal Reserve be if they were not ready to keep our dollar supply at a level consistent with the growing global demand?

FACT: The artificial dollar demand created by the petrodollar system returned to Washington the “permission slip” to supply the global economy with freshly printed dollars that it lost after the demise of the Bretton Woods agreement.

The artificial dollar demand created by the petrodollar system has “permitted” Washington to go on multiple spending sprees to further create their “welfare and warfare” state.

And with so many dollars floating around the globe, America’s asset prices (including houses, stocks, etc.) naturally rose. After all, as we have already demonstrated, prices are directly related to the available money supply.

With this in mind, it is easy to see why maintaining a global demand for dollars is vital to our national “illusion of prosperity” and our “national security.” (The lengths at which America has already gone to protect the petrodollar system will be explained in our third article of this series.)

When, not if, the petrodollar system collapses, America will lose its “permission slip” to print excessive numbers of U.S. dollars.

When this occurs, the number of dollars in existence will far exceed the actual demand. This is the classical definition of hyperinflation. Since 2006, I have been teaching that America’s bout with hyperinflation will be tied in some way with a breakdown of the petrodollar system and the artificial dollar demand that it has created.

When hyperinflation strikes America, it will be very difficult to stop without drastic measures. One possible measure will be a quick and massive reduction in the overall supply of U.S. dollars. However, with a reduction of the supply of dollars will come a massive reduction in the value of assets currently denominated in U.S. dollars.

(I will explain more about potential scenarios of the petrodollar collapse along with personal strategies that you can take in the fourth and final article in this series.)

2. The petrodollar system increases demand for U.S. debt securities

One of the most brilliant aspects of the petrodollar system was requesting that oil producing nations take their excess oil profits and place them into U.S. debt securities in Western banks. This system would later become known as “petrodollar recycling” as coined by Henry Kissinger. Through their exclusive use of dollars for oil transactions, and then depositing their excess profits into American debt securities, the petrodollar system is a “dream come true” for a spendthrift government like the United States.

Despite its obvious benefits, the petrodollar recycling process is both unusual and unsustainable. It has served to distort the true demand for government debt that has “permitted” the U.S. government to maintain artificially low interest rates. Washington has become dependent upon these artificially low interest rates and, therefore, have a vested interest in maintaining them through any means necessary. The massive economic distortions and imbalances generated by the petrodollar system will eventually self-correct when the artificial dollar and U.S. debt demand is removed.

That day is coming.

3. The petrodollar system allows the U.S. to buy oil with a currency it can print at will

The third major benefit of the petrodollar system for the U.S. has to do with the actual purchase of oil itself.

Like all modern developed economies, the United States has built most of its infrastructures around the use of petroleum-based energy supplies. And like many nations, the U.S. consumes more oil each year than it can produce on its own. Therefore, it has become dependent upon foreign nations to fill the supply gap.What makes America different, however, is that it can pay for 100% of its oil imports with its own currency.

Again, it does not take much economic knowledge to figure out that this is a great deal.

Let’s use another quick example. Imagine that you and I both live in an unusual city where the only method of payment for gasoline for our automobiles is carrots. Now, imagine that I own the exclusive rights in our town to grow carrots, and I have the only existing carrot farm in our town. For you, this means that in order to buy any gasoline, you must first deal with me. You can come and attempt to barter with me, or you can buy carrots from me. But regardless, it is an inconvenient fact of life for you. However, it is exactly the opposite for me. Since I can create carrots out of the ground, I just plant a seed, water the seed, and then exchange the carrot for gasoline. America has managed to create a similar place for itself in an oil-dependent global economy. With oil priced in U.S. dollars, America can literally print money to buy oil… and then have the oil producers hold the debt that was created by printing the money in the first place.

What other nation, besides America, can print money to buy oil and then have the oil producers hold the debt for the printed money?

Obviously, the creation of the petrodollar system was a brilliant political and economic move. Washington was acutely aware in the early 1970’s that the demand curve for oil would increase dramatically with time. Therefore, they positioned the dollar as the primary medium of exchange for all global oil transactions through the petrodollar system. This single political move created a growing international demand for both the U.S. dollar and U.S. debt — all at the expense of oil-producing nations.

For a very simplistic video explanation of the petrodollar system by Jerry Robinson, watch the video below…

How the Petrodollar System Has Affected U.S. Relations With Israel.

Before we conclude, there is one politically sensitive topic that needs to be addressed that will help further clarify the true effects of the petrodollar system. Namely,how the petrodollar system has affected America’s relationship with Israel.

If you were to ask most Americans today if the United States has been a close friend and ally of Israel, most would answer with a resounding “yes.” This is especially true of Evangelical Christians who believe that America’s foreign policy in the Middle East should be driven, and even dictated, by Israel. Evangelicals often side with Republican candidates who promise to “look out for” Israel and to “stand up for” Israel.

But, is there any solid evidence that America’s foreign policy measures, and actions in the Middle East have been guided by anything but upholding and protecting the petrodollar system?

I would strongly suggest that the answer is no.

Why is this important? Because I believe that the American population and Evangelicals in particular, have been hoodwinked with the “pro-Israel” chatter that pours out of most our political leader’s mouths.

Instead of being a true friend and ally to Israel, I believe that America has cleverly used its “relationship” with the Jewish state as a cover for its military adventurism in the Middle East. (In our next article, I will suggest that most of the military action that America has taken in the Middle East has had more to do with protecting the petrodollar system and less to do with defending Israel.)

Still, many Americans, including most Evangelicals, buy the hype being pumped out of Washington’s political spin rooms. If you turn off the corporate-controlled mainstream media for a day, however, and speak to the real inhabitants of the Middle East, a very different story emerges.

Would a true friend belittle your autonomy and self-determination by denying your right to defend yourself, all because they have made backroom deals with your enemies for financial gain?

Would a true friend seek to make you dependent upon financial aid and then give eight times more financial aid to your sworn enemies?

Yet, this is exactly what America has done to Israel in the name of “friendship.”

When Israel seeks to defend her territory, America always rushes to prevent it.

Have you ever found yourself asking why America, and other Western interests who benefit from continued good relations with oil-producing nations, urge Israel to restrain herself? After all, who are we to intervene in a sovereign nation’s foreign policy decisions?

Again, the truth is found when you follow the money…

As you may recall, part of the petrodollar agreement requires that the United States guarantee protection for Middle Eastern oil-producing nations from the threats specifically imposed by the Jewish state.

When dispensing foreign aid into the Middle East, does America give money exclusively to Israel and her allies? No.

Instead, Israel’s sworn enemies receive eight times more in foreign aid than Israel does.

How can you give free money and weapons to the enemies of your so-called “best friend” and keep a straight face?

While the masses clamor at the feet of those leaders who profess “support for Israel,” I would suggest that they have rarely stopped to ask what that American “support” really looks like?

The Jewish identity, as expressed in Zionism, is one that is deeply rooted in autonomy and self-determination.

It is my belief that America’s so-called “support” for Israel has served as a crafty cover for maintaining a military presence in the region… all to protect our national interests.

America has attempted to play both sides of this Middle East game for far too long. And it has used the corporate-controlled media to control the American public for decades. They have kept us ignorant of the truth.

Keeping the Middle East inflamed and destabilized has been a stated goal of Western interests for decades. This is the name of the game when your goal is empire. And empires do not have friends… they have subjects.

It is time that Americans wake up and realize that we need to stop listening to the flapping jaws of the politicians and to the derelict corporate-controlled media, and instead, we should follow the money.

Maintaining the petrodollar system is the American empire’s primary goal. Everything else is secondary.

How you can profit from the petrodollar collapse

Download entire 50 pages PDF article series, and also get Exclusive deals, early access to new product releases, cutting-edge trend research, and our weekly podcast

Ready to Read Part Three?

In part three of this four-part series, I will explain how America has handled the growing international challenges to the petrodollar system. The consequences have been nothing short of tragic. I have entitled it “The Petrodollar Wars”. Part three will focus specifically on the 2003 Iraq war.